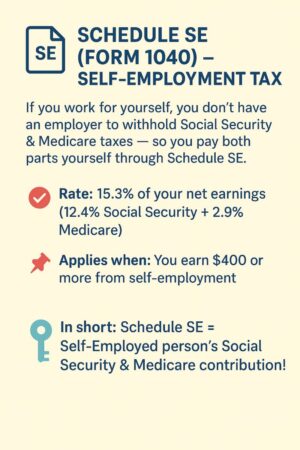

Schedule SE (Form 1040) – For the Self-Employment Tax

💡 Schedule SE (Form 1040) – For the Self-Employment Tax :-

If you work for yourself, you don’t have an employer to withhold Social Security & Medicare taxes — so you pay both parts yourself through Schedule SE.

📊 Self-Employment Tax

📌 Rate: 15.3% of your net earnings (12.4% Social Security + 2.9% Medicare)

📌 Applies when: You earn $400 or more from self-employment.

🧮 Example:

You earn $60,000 from freelancing.

➡️ Taxable portion = 92.35% × $60,000 = $55,410

➡️ Self-Employment Tax = 15.3% × $55,410 = $8,473.73

✅ You can deduct half ($4,236.87) on your Form 1040 to reduce taxable income.

hashtagNoted:-💡 Why only = 92.35% ? (Taxable portion)

*When you’re self-employed, you pay both the employer and employee share of Social Security & Medicare (total 15.3%).

*However, the IRS lets you treat the “employer half” (7.65%) as a business expense before calculating your self-employment tax.

*So instead of paying tax on 100% of your income,

you pay it on 92.35% (= 100% − 7.65%).

🧮 Example:

*Income = $60,000

*Taxable portion = 92.35% × $60,000 = $55,410

*Self-employment tax = 15.3% × $55,410 = $8,473.73

✅ This adjustment prevents you from being taxed on the part considered your “employer contribution.”

👉 92.35% rule = gives you credit for the employer’s share of payroll taxes that regular employees don’t pay directly.

🔑 In short:

Schedule SE = How self-employed people pay Social Security & Medicare.