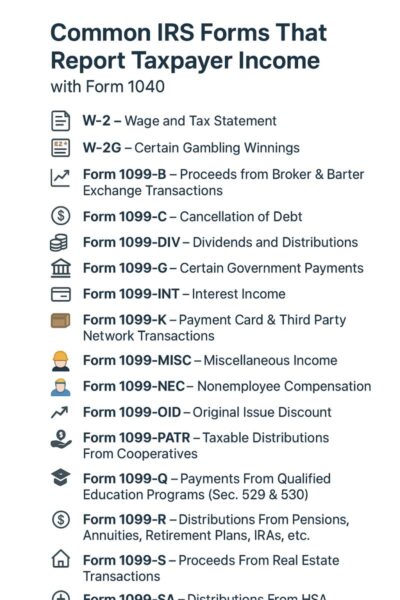

Common IRS Forms That Report Taxpayer Income (with Form 1040)

💡 Common IRS Forms That Report Taxpayer Income (with Form 1040)

Each of these forms can indicate potential sources of gross income for tax reporting:-

1)📄 W-2 – Wage and Tax Statement

2)🎰 W-2G – Certain Gambling Winnings

3)💹 Form 1099-B – Proceeds from Broker & Barter Exchange Transactions

4)💸 Form 1099-C – Cancellation of Debt

5)🏦 Form 1099-DIV – Dividends and Distributions

6)🏛️ Form 1099-G – Certain Government Payments

7)💰 Form 1099-INT – Interest Income

8)💳 Form 1099-K – Payment Card & Third Party Network Transactions

9)📦 Form 1099-MISC – Miscellaneous Income

10)👷 Form 1099-NEC – Nonemployee Compensation

11)📈 Form 1099-OID – Original Issue Discount

12)🤝 Form 1099-PATR – Taxable Distributions From Cooperatives

13)🎓 Form 1099-Q – Payments From Qualified Education Programs (Sec. 529 & 530)

14)🪙 Form 1099-R – Distributions From Pensions, Annuities, Retirement Plans, IRAs, etc.

15)🏠 Form 1099-S – Proceeds From Real Estate Transactions

16)💊 Form 1099-SA – Distributions From HSA, Archer MSA, or Medicare Advantage MSA

17)👥 Schedule K-1 (Form 1065) – Partner’s Share of Income, Deductions, Credits

18)🏢 Schedule K-1 (Form 1120-S) – Shareholder’s Share of Income, Deductions, Credits