Similar Posts

𝗛𝗼𝘄 𝗔𝗠𝗧 𝗣𝗹𝗮𝗻𝗻𝗶𝗻𝗴 𝗦𝗮𝘃𝗲𝗱 $𝟭𝟱,𝟱𝟳𝟰 𝗶𝗻 𝗧𝗮𝘅𝗲𝘀

BytaxtiumMany high-income taxpayers don’t realize that ignoring the Alternative Minimum Tax (AMT) can significantly increase their tax liability. Here’s a real-world style example: *Without planning, the taxpayer owed $85,424 under AMT. *With proper planning, liability was reduced to $69,850 — a tax savings of $15,574. This case study breaks down: * Regular Tax Calculation *…

S-Corporation Election

BytaxtiumHow To File S-Corporation Election The election of S corporation status is made by filing a form called “Election by a Small Business Corporation” with the IRS Service Center, where the corporation files its corporate federal income tax return. The election of the S corporation status must be unanimously approved by all of the shareholders…

Understanding Tax Benefits: Deductions vs. Credits

BytaxtiumWhat Are Tax Deductions?A tax deduction reduces your taxable income, which in turn lowers the amount of tax you owe. Think of it as a way to shrink the portion of your income that is subject to taxation. For example: If you earn $50,000 a year and claim a $5,000 deduction, your taxable income becomes…

The OBBBA timeline

BytaxtiumThe OBBBA timeline, powered by the AICPA — a great cheat sheet for the key provisions and when they take effect.

𝗗𝗶𝗱 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄 𝗧𝗵𝗮𝘁 𝗖𝗹𝗮𝗶𝗺𝗶𝗻𝗴 𝗮 𝗗𝗲𝗽𝗲𝗻𝗱𝗲𝗻𝘁 𝗣𝗮𝗿𝗲𝗻𝘁 𝗖𝗼𝘂𝗹𝗱 𝗖𝗼𝗺𝗽𝗹𝗲𝘁𝗲𝗹𝘆 𝗙𝗹𝗶𝗽 𝗬𝗼𝘂𝗿 𝗧𝗮𝘅 𝗙𝗶𝗹𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆?

BytaxtiumMost married taxpayers file jointly (MFJ) thinking it’s always the best route. But here’s something most don’t pause to re-check during tax prep season: 📌 If you’re supporting your elderly parent, and your income hits certain thresholds… ➡️ 𝗛𝗲𝗮𝗱 𝗼𝗳 𝗛𝗼𝘂𝘀𝗲𝗵𝗼𝗹𝗱 (𝗛𝗢𝗛) 𝗺𝗶𝗴𝗵𝘁 𝘀𝗮𝘃𝗲 𝘆𝗼𝘂 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗠𝗙𝗝 𝘄𝗼𝘂𝗹𝗱. 𝗟𝗲𝘁 𝗺𝗲 𝗯𝗿𝗲𝗮𝗸 𝗶𝘁 𝗱𝗼𝘄𝗻: 📁…

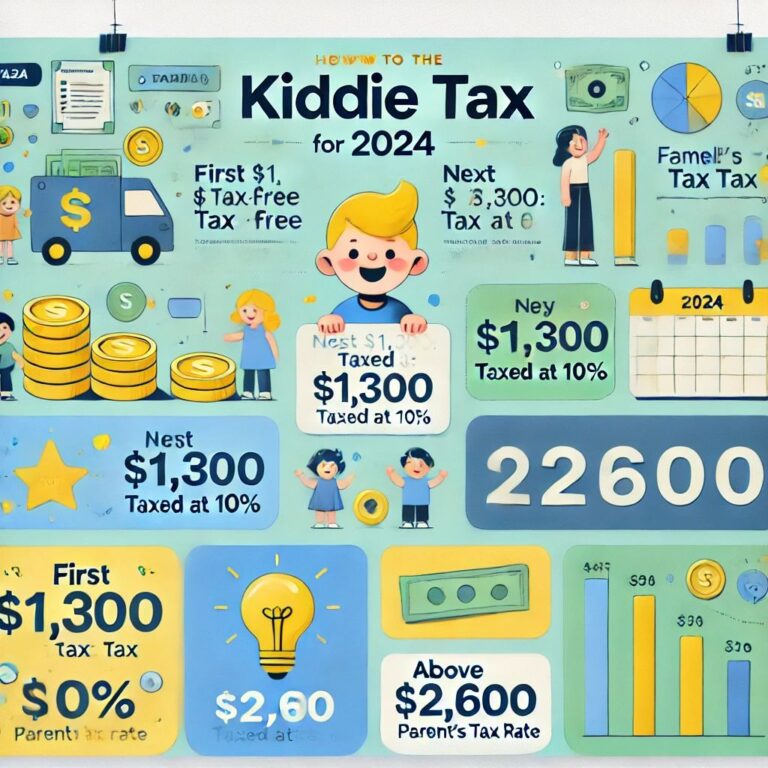

Understanding the Kiddie Tax for 2024: How It Affects Your Child’s Investment Income

BytaxtiumAs tax season approaches, it’s important to understand how the Kiddie Tax impacts children with investment income. The Kiddie Tax was introduced to prevent parents from shifting investment income to their children to take advantage of lower tax rates. Here’s a quick breakdown of how it works for the 2024 tax year and how it…