Similar Posts

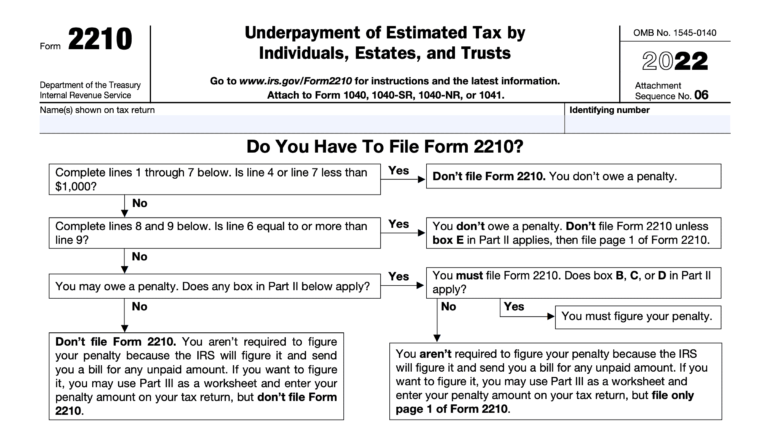

Got Hit With a Tax Penalty Even Though You Paid? (Form 2210)

Bytaxtium🧾 Got Hit With a Tax Penalty Even Though You Paid? Read This. 🎯 It happens more often than you’d think. You work hard, pay your taxes by year-end, and still get slapped with an IRS penalty.Why? Because the IRS wants you to pay as you earn—not just at the end. But don’t worry—Form 2210…

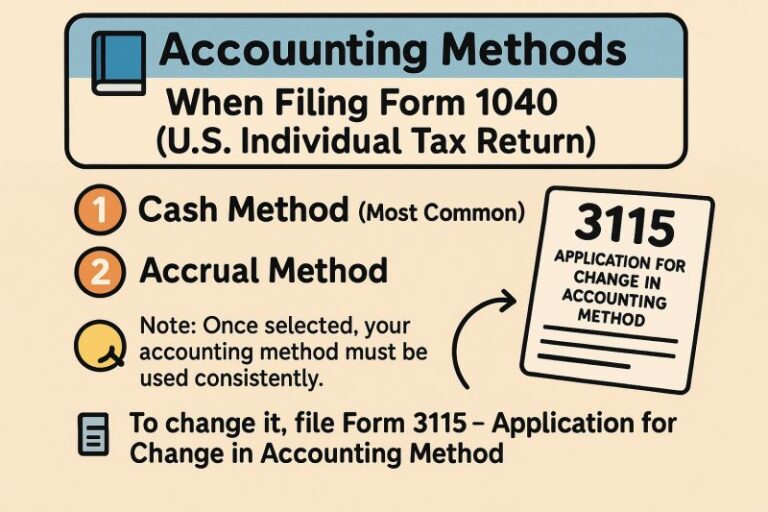

10 – Accounting Methods When Filing Form 1040 (U.S. Individual Tax Return)

Bytaxtium📘 Accounting Methods When Filing Form 1040 (U.S. Individual Tax Return) When reporting income and expenses, the IRS allows individuals to use one of the following accounting methods: 1️⃣ Cash Method (Most Common) ✅ Income is reported when received ✅ Expenses are deducted when paid 🧾 Simple and ideal for employees, freelancers & small businesses…

Detailed State-Wise W-2 Filing Guide for Employers

BytaxtiumAttention Employers: Stay Compliant with State-Specific W-2 Filing Requirements! As the federal Form W-2 filing deadline approaches, don’t forget to check state-specific filing requirements. Some states require additional W-2 submissions, while others have no such mandates. Here’s a detailed breakdown to guide you: W-2 Filing Requirements by StateStates Requiring W-2 Filing Alabama (AL): W-2 required;…

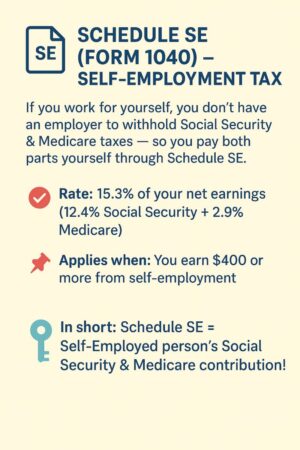

Schedule SE (Form 1040) – For the Self-Employment Tax

Bytaxtium💡 Schedule SE (Form 1040) – For the Self-Employment Tax :- If you work for yourself, you don’t have an employer to withhold Social Security & Medicare taxes — so you pay both parts yourself through Schedule SE. 📊 Self-Employment Tax 📌 Rate: 15.3% of your net earnings (12.4% Social Security + 2.9% Medicare) 📌…

Social Security Benefits and Their Taxability

BytaxtiumDid you know that your Social Security benefits could be taxable depending on your income? Understanding the taxability of these benefits is crucial for managing your taxes efficiently. Here’s everything you need to know! When Are Social Security Benefits Taxable? Your benefits may become taxable if your combined income exceeds certain thresholds. Combined income includes:…

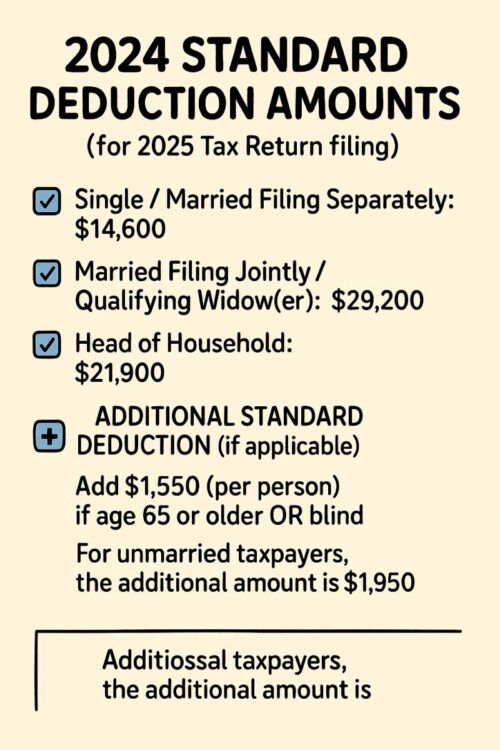

07b – Standard Deduction

Bytaxtium🧾 Standard Deduction: – ✅ What is the Standard Deduction? A fixed dollar amount that reduces from your taxable income No need to provide receipts or itemize expenses Automatically applied unless you choose to itemize deductions 📌 2025 Standard Deduction Amounts (for Tax Returns filed in April 2026): Single / Married Filing Separately: $15,750 Married…