Similar Posts

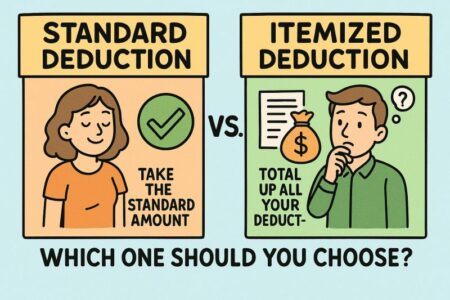

07c – Standard Deduction vs. Itemized Deduction – Which One Should You Choose?

Bytaxtium🧾 Standard Deduction vs. Itemized Deduction – Which One Should You Choose? When filing IRS Form 1040, you have two ways to reduce your taxable income: ✅ Standard Deduction ✅ Itemized Deductions (Schedule A) But you can claim only ONE. So, which is better for you? Let’s break it down: 🔹 Standard Deduction Fixed amount…

𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐯𝐬. 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔

Bytaxtium𝐂𝐨𝐧𝐟𝐮𝐬𝐞𝐝 𝐛𝐞𝐭𝐰𝐞𝐞𝐧 𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐚𝐧𝐝 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔? 𝐇𝐞𝐫𝐞’𝐬 𝐚 𝐪𝐮𝐢𝐜𝐤 𝐛𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧 𝐭𝐨 𝐡𝐞𝐥𝐩 𝐲𝐨𝐮 𝐜𝐡𝐨𝐨𝐬𝐞 𝐭𝐡𝐞 𝐛𝐞𝐬𝐭 𝐭𝐚𝐱-𝐬𝐚𝐯𝐢𝐧𝐠 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐰𝐡𝐞𝐧 𝐝𝐞𝐚𝐥𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐢𝐧𝐜𝐨𝐦𝐞. 📌 𝐄𝐥𝐢𝐠𝐢𝐛𝐢𝐥𝐢𝐭𝐲 🔹 Form 2555: Must 𝐥𝐢𝐯𝐞 𝐚𝐧𝐝 𝐰𝐨𝐫𝐤 𝐚𝐛𝐫𝐨𝐚𝐝 (330+ days or bona fide residence). 🔹 Form 1116: No residency needed. Just f𝐨𝐫𝐞𝐢𝐠𝐧-𝐬𝐨𝐮𝐫𝐜𝐞 𝐢𝐧𝐜𝐨𝐦𝐞 𝐚𝐧𝐝 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐭𝐚𝐱𝐞𝐬 𝐩𝐚𝐢𝐝. 📌 𝐈𝐧𝐜𝐨𝐦𝐞…

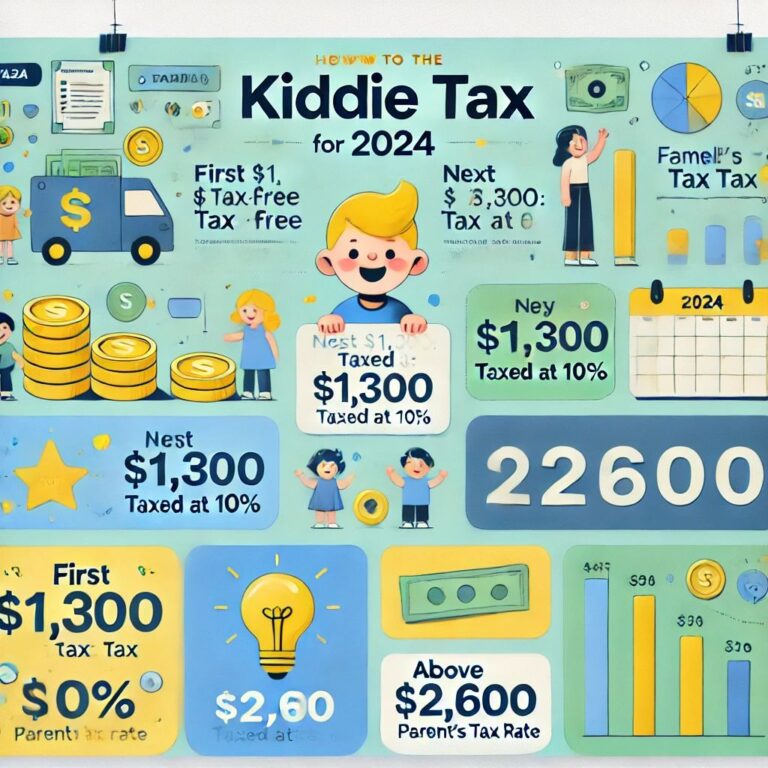

Understanding the Kiddie Tax for 2024: How It Affects Your Child’s Investment Income

BytaxtiumAs tax season approaches, it’s important to understand how the Kiddie Tax impacts children with investment income. The Kiddie Tax was introduced to prevent parents from shifting investment income to their children to take advantage of lower tax rates. Here’s a quick breakdown of how it works for the 2024 tax year and how it…

General | IRS | Tax Common Mistakes | Tax Credits | Tax Tips

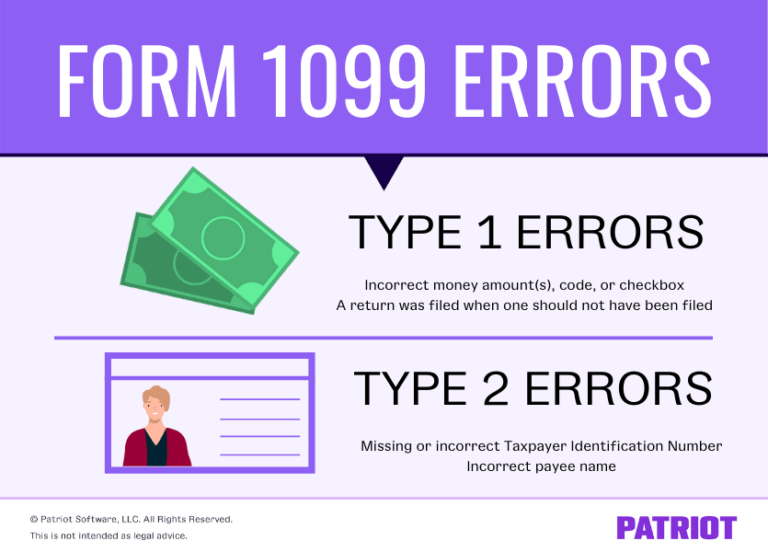

General | IRS | Tax Common Mistakes | Tax Credits | Tax Tips𝐓𝐡𝐞 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝐢𝐧 𝐓𝐚𝐱 𝐏𝐫𝐞𝐩𝐚𝐫𝐚𝐭𝐢𝐨𝐧: 𝐀 𝐋𝐞𝐬𝐬𝐨𝐧 𝐟𝐫𝐨𝐦 𝐚 𝟏𝟎𝟗𝟗-𝐑 𝐅𝐢𝐥𝐢𝐧𝐠 𝐄𝐫𝐫𝐨𝐫

BytaxtiumIn my recent review of a tax return, I came across an input error that highlights the critical importance of precision in tax preparation. Here’s the scenario: A client received $𝟓,𝟎𝟎𝟎 in annuities, reported as Gross Distribution (𝐁𝐨𝐱 𝟏) on Form 1099-R. The distribution was a 𝐍𝐨𝐫𝐦𝐚𝐥 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 from their Pension account. However, the tax…

Form W-2 – Wage and Tax Statement (Summary of Wages/paycheck)

Bytaxtiumorm W-2 is an IRS tax form that employers must provide to employees each year. It reports the employee’s annual wages and the taxes withheld from their paycheck . 🔍 Key Points 1️⃣ Who issues it? • Employers send it to both the employee and the IRS. 2️⃣ Who receives it? • All employees (not…

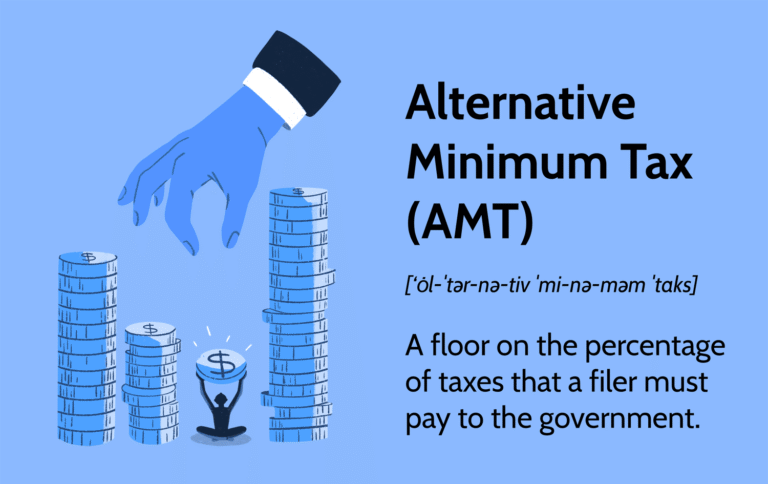

𝗛𝗼𝘄 𝗔𝗠𝗧 𝗣𝗹𝗮𝗻𝗻𝗶𝗻𝗴 𝗦𝗮𝘃𝗲𝗱 $𝟭𝟱,𝟱𝟳𝟰 𝗶𝗻 𝗧𝗮𝘅𝗲𝘀

BytaxtiumMany high-income taxpayers don’t realize that ignoring the Alternative Minimum Tax (AMT) can significantly increase their tax liability. Here’s a real-world style example: *Without planning, the taxpayer owed $85,424 under AMT. *With proper planning, liability was reduced to $69,850 — a tax savings of $15,574. This case study breaks down: * Regular Tax Calculation *…