Understanding IRS Estimated Tax Payments for 2024

n the U.S., taxpayers often need to pay estimated taxes throughout the year if they don’t have enough tax withheld from income sources like self-employment, investments, or other earnings. This system ensures you pay taxes as you earn income, avoiding penalties at the end of the year.

📌Who Should Pay Estimated Taxes?

You should make estimated tax payments if:

• You expect to owe at least $1,000 in taxes after subtracting withholdings and credits.

• Your tax withholding is less than 90% of the tax for 2024 or 100% of the previous year’s tax (110% for higher incomes in excess of $150,000)

Examples of taxpayers:

• Self-employed individuals

• Freelancers, contractors

• Investors earning capital gains

• Farmers and fishermen (special rules apply)

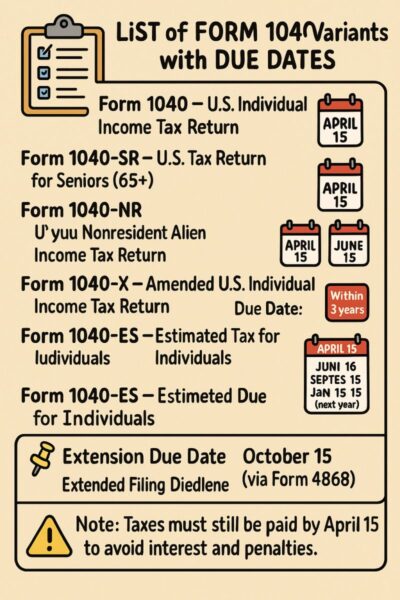

⏳Payment Deadlines for 2024

Estimated taxes are paid quarterly:

1. 1st Quarter: April 15, 2024

2. 2nd Quarter: June 17, 2024

3. 3rd Quarter: September 16, 2024

4. 4th Quarter: January 15, 2025

If the due date falls on a weekend or holiday, it shifts to the next business day.

📌Special Rules for Farmers and Fishermen🧑🌾

Farmers and fishermen qualify for reduced payment requirements if at least 2/3 of their annual income comes from farming or fishing.

• One Payment Rule: Instead of paying quarterly, they can file a single estimated payment by January 15, 2025.

• Alternatively, they can file their full return and pay any tax owed by March 1, 2025, to avoid penalties.

Example:

• John, a fisherman, earns 70% of his income from fishing. He can skip the quarterly payments and pay his full tax amount when he files by March 1, 2025.

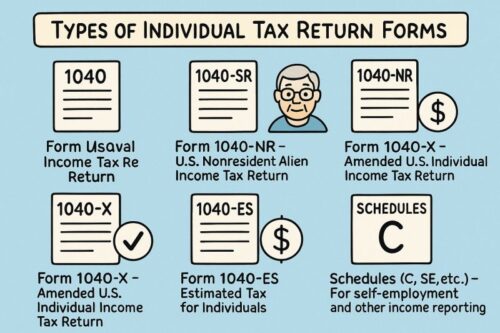

📌How to Calculate Estimated Tax

1. Estimate your total income, deductions, and credits for the year.

2. Use Form 1040-ES to calculate your tax liability.

3. Subtract taxes already paid or withheld.

4. Divide the remaining amount into four equal payments.

Example:

• Sarah is a freelancer and expects to earn $80,000 in 2024. Her estimated tax liability is $12,000 after accounting for deductions and credits.

• Quarterly payments = $12,000 ÷ 4 = $3,000 per quarter.

📌How to Pay

• Online: IRS Direct Pay, IRS2Go App, or EFTPS

• Mail: By check with a completed payment voucher from Form 1040-ES

• Automatic withdrawals

⚠️Penalties for Not Paying

If you miss deadlines or underpay, the IRS may impose penalties. Avoid this by:

• Paying at least 90% of your 2024 tax or 100% of your 2023 tax.

Summary:

Estimated tax payments ensure compliance with the IRS “pay-as-you-go” system. Farmers and fishermen benefit from special provisions. Plan ahead, calculate carefully, and pay on time to avoid penalties.

Does your website have a contact page? I’m having problems locating

it but, I’d like to shoot you an e-mail. I’ve got some creative ideas for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it develop over time.

Yes it does, see top bar

Heya i am for the first time here. I found this board and I to find It truly helpful & it helped me out much. I hope to offer one thing back and help others like you aided me.

Pretty! This has been an incredibly wonderful post. Thank you for providing this information.