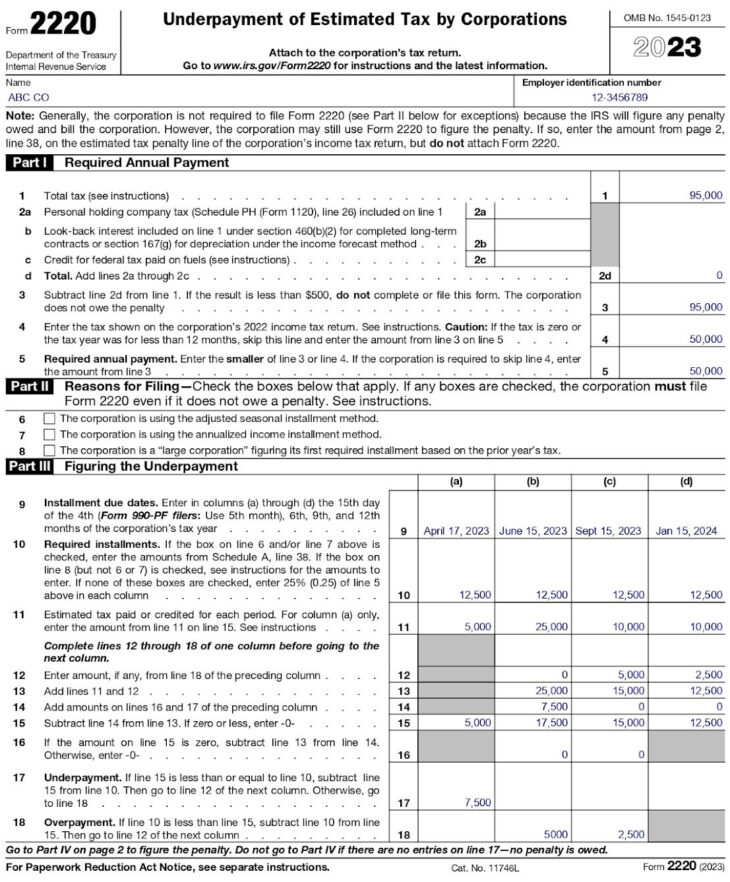

Did you know corporations can face penalties if they don’t pay enough estimated taxes on time? That’s where Form 2220 comes in—it’s not just another IRS form; it’s your safeguard against unnecessary penalties!

Here’s why it matters:

Who Needs It?

Corporations and entities that owe more than $500 in tax after credits.

Businesses with fluctuating income throughout the year.

What Does It Do?

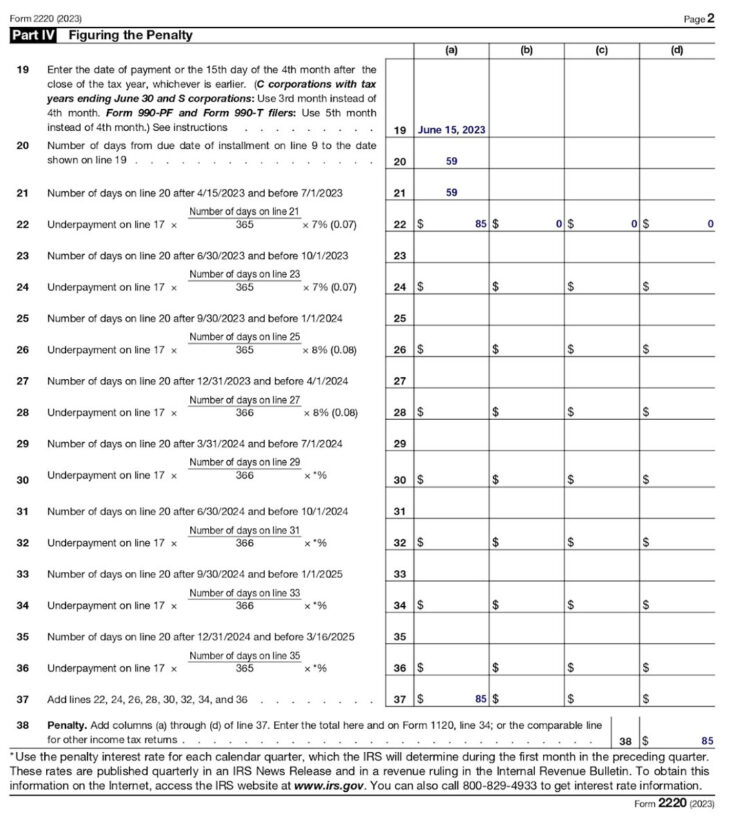

Helps calculate penalties for underpayment of estimated taxes.

Allows you to adjust payments to avoid year-end surprises.

Why It’s a Game Changer:

Proactive planning through this form ensures compliance with IRS safe harbor rules.

It can save you money by identifying shortfalls early and avoiding penalties.

For instance, did you know that if your estimated payments cover 100% of last year’s tax or 90% of this year’s tax, you might avoid penalties entirely? Small details like this can make a big difference!

Have questions about Form 2220 or related filings like 1120, 1120S, or 1065? Let’s connect and simplify your tax journey!

💡 Why You Should Start Thinking About Taxes Now (Not Just in April) Most people only think about taxes when it’s almost time to file — usually around April 15th.But here’s the truth: by then, it’s too late to actually save on taxes. Good tax planning doesn’t start when you’re filing your return — it…

IRS already updated the 2025 tax deadlines for non-US LLC owners. And they aren’t what you think. Most founders are still working off 2024 calendars. That’s a four-figure mistake waiting to happen… Here are the dates that matter RIGHT NOW: → March 17, 2025: Form 1120 (if your LLC elected C-corp status) → April…