Kiddie Tax Rules

Master the Kiddie Tax Rules for 2025 with Confidence!

The Kiddie Tax ensures that a child’s unearned income is taxed fairly. For parents managing a dependent child’s investments or passive income, understanding this rule is essential. Here’s a detailed breakdown for 2024:

• It applies to dependent children under:

• 19 years of age, OR

• 24 years if they are full-time students (and didn’t provide more than half their own support).

• Unearned income (such as interest, dividends, or capital gains) exceeding certain thresholds is taxed at parental tax rates.

• $1,300: Unearned income is not taxed (standard deduction for dependents).

• $1,301 – $2,600: Taxed at the child’s tax rate.

• Above $2,600: Taxed at parental tax rates.

If parents are married and living together :

• The combined income of both parents is used to determine the Kiddie Tax.

If parents are divorced or separated :

• The custodial parent’s income is used unless a legal agreement specifies otherwise.

If the custodial parent is remarried :

• The Kiddie Tax is calculated using the custodial parent and their new spouse’s combined income.

If parents were never married:

• The Kiddie Tax is based on the income of the parent with the greater taxable income, regardless of custody arrangements.

• Earned income (e.g., wages from a job or side gig) is exempt from Kiddie Tax.

• Unearned income (e.g., investments, dividends, capital gains) is subject to Kiddie Tax rules.

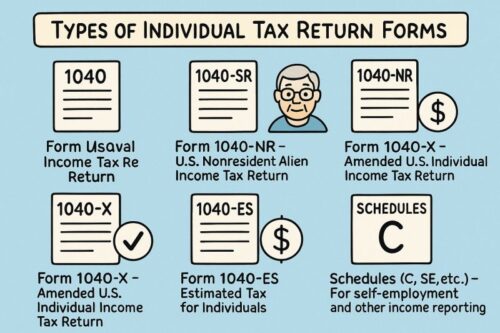

A child must file Form 8615 if:

• Their unearned income exceeds $2,600.

• They are required to file a tax return.

• They meet the age and dependency criteria.

• Invest in Tax-Advantaged Accounts: Use 529 plans or custodial IRAs to reduce taxable unearned income.

• Stay Under the Thresholds: Opt for tax-efficient funds or split investments wisely.

• Keep Accurate Records: Track all sources of unearned income for easy filing.

• Tax filing deadline: April 15, 2025.

• Extended filing deadline: October 15, 2025 (if applicable)

Need help navigating the Kiddie Tax?

From filing Form 8615 to optimizing tax strategies based on your family’s situation, consult a tax professional to help you simplify your 2025!