Similar Posts

The new tax season coming up

BytaxtiumThe new tax season coming up and the number of NRAs increasing every year. 𝗟𝗲𝘁𝘀 𝗹𝗲𝗮𝗿𝗻 𝗮𝗹𝗹 𝗮𝗯𝗼𝘂𝘁 𝗜𝗧𝗜𝗡 𝘁𝗼𝗱𝗮𝘆- An Individual Taxpayer Identification Number (ITIN) is a nine-digit number issued by the Internal Revenue Service (IRS) to individuals who are required to have a taxpayer identification number but are not eligible for a Social…

Kiddie Tax Rules

BytaxtiumMaster the Kiddie Tax Rules for 2025 with Confidence! The Kiddie Tax ensures that a child’s unearned income is taxed fairly. For parents managing a dependent child’s investments or passive income, understanding this rule is essential. Here’s a detailed breakdown for 2024: What is the Kiddie Tax? • It applies to dependent children under: •…

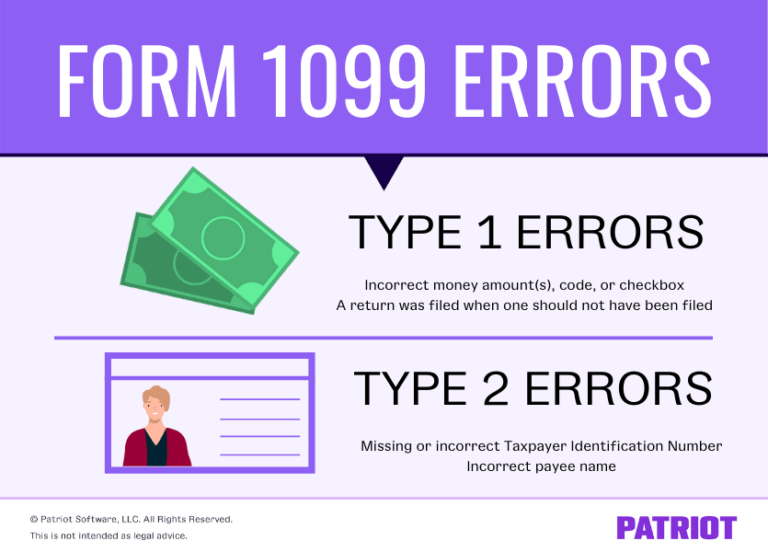

General | IRS | Tax Common Mistakes | Tax Credits | Tax Tips

General | IRS | Tax Common Mistakes | Tax Credits | Tax Tips𝐓𝐡𝐞 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝐢𝐧 𝐓𝐚𝐱 𝐏𝐫𝐞𝐩𝐚𝐫𝐚𝐭𝐢𝐨𝐧: 𝐀 𝐋𝐞𝐬𝐬𝐨𝐧 𝐟𝐫𝐨𝐦 𝐚 𝟏𝟎𝟗𝟗-𝐑 𝐅𝐢𝐥𝐢𝐧𝐠 𝐄𝐫𝐫𝐨𝐫

BytaxtiumIn my recent review of a tax return, I came across an input error that highlights the critical importance of precision in tax preparation. Here’s the scenario: A client received $𝟓,𝟎𝟎𝟎 in annuities, reported as Gross Distribution (𝐁𝐨𝐱 𝟏) on Form 1099-R. The distribution was a 𝐍𝐨𝐫𝐦𝐚𝐥 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 from their Pension account. However, the tax…

Understanding Tax Benefits: Deductions vs. Credits

BytaxtiumWhat Are Tax Deductions?A tax deduction reduces your taxable income, which in turn lowers the amount of tax you owe. Think of it as a way to shrink the portion of your income that is subject to taxation. For example: If you earn $50,000 a year and claim a $5,000 deduction, your taxable income becomes…

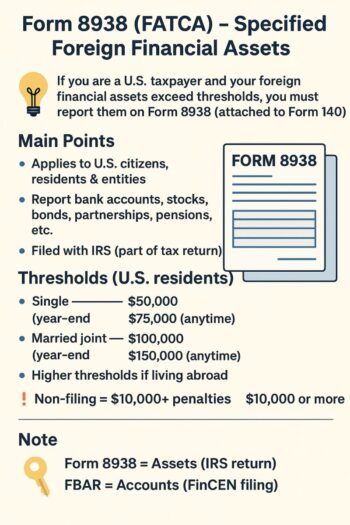

Form 8938 (FATCA) – Specified Foreign Financial Assets

Bytaxtium💡 Form 8938 (FATCA) – Specified Foreign Financial Assets :- If you are a U.S. taxpayer and your foreign financial assets exceed certain thresholds, you must report them on Form 8938 (attached to your Form 1040). 📌 Main Points :- • Applies to U.S. citizens, residents & certain entities. • Report bank accounts, stocks, bonds,…

A Comprehensive Guide to Form 1040 Schedule 1

BytaxtiumA Comprehensive Guide to Form 1040 Schedule 1Form 1040 Schedule 1 is a supplemental form used to report specific types of additional income and adjustments to income that are not included directly on the main Form 1040. Filing this form is essential for taxpayers who have income or deductions falling into specific categories. Purpose of…