Exploring U.S. Topography and State Tax Landscape

Exploring U.S. Topography and State Tax Landscape

The United States is known for its diverse topography, ranging from the towering Rocky Mountains and serene Appalachian ranges to the sprawling Great Plains and vibrant coastal lines. This geographical diversity shapes not only the country’s culture and lifestyle but also its economic and tax systems.

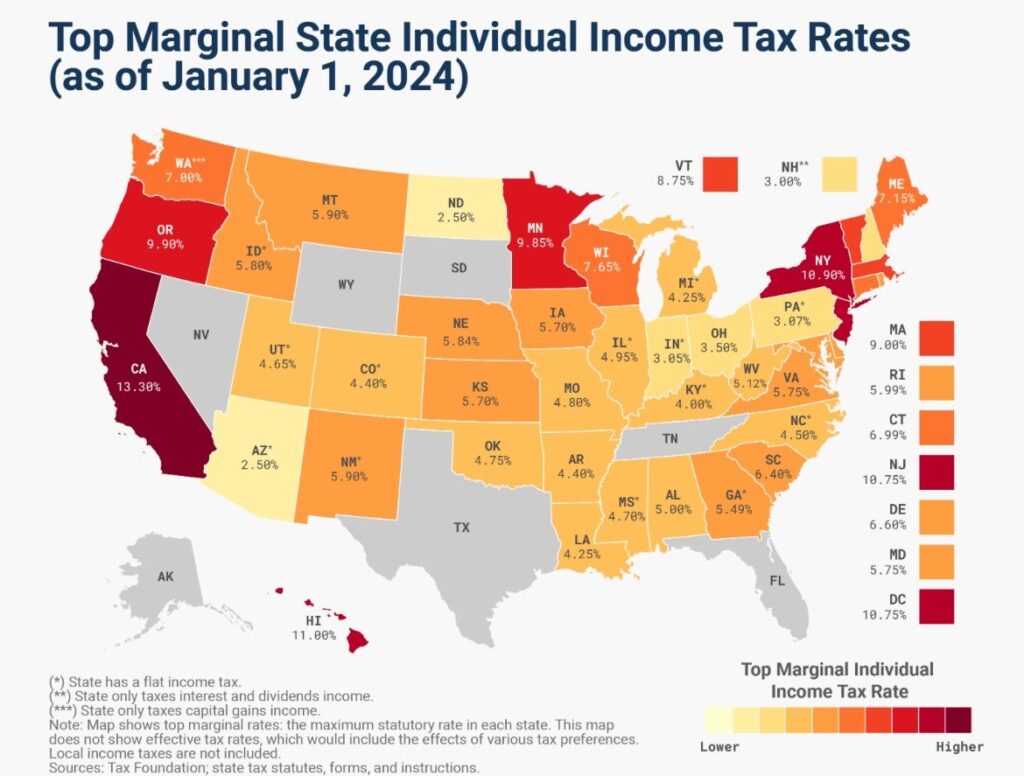

When it comes to state taxes, the U.S. has a wide variation. Some states are considered tax-friendly due to the absence of state income tax, while others impose state income taxes to fund public services.

States with No State Income Tax:

1. Alaska

2. Florida

3. Nevada

4. New Hampshire (limited to interest and dividends)

5. South Dakota

6. Tennessee

7. Texas

8. Washington

9. Wyoming

States with State Income Tax:

The remaining 41 states, including California, New York, and Illinois, impose state income taxes. These tax rates can be flat or progressive, with some states offering deductions and credits to ease the tax burden.

Key Insights for Residents and Businesses:

• Living in a tax-exempt state may lower your overall tax liability, but other factors like property and sales taxes can impact your finances.

• States with income tax often use these revenues to fund education, healthcare, and infrastructure.

Understanding the topography of U.S. taxation is as essential as appreciating its physical landscapes. Each state’s approach reflects its unique priorities and economic strategies.

What’s your take on balancing taxes and topography? Let’s discuss.