Comprehensive Guide to IRS Form 8938 – Statement of Specified Foreign Financial Assets

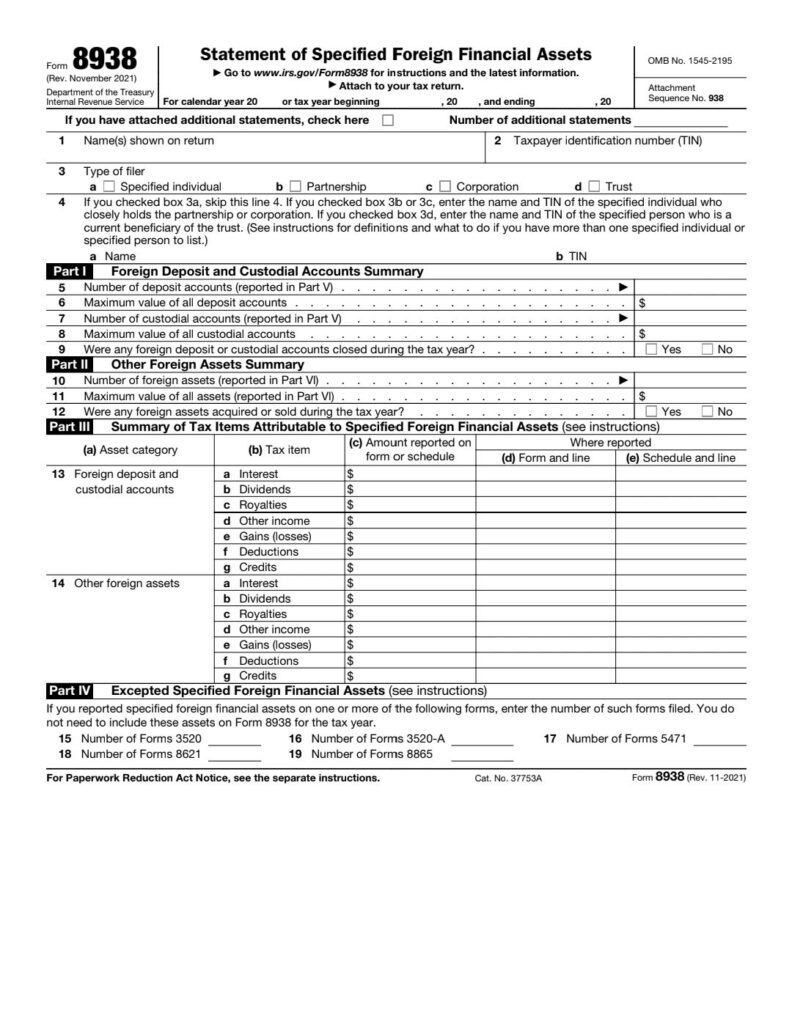

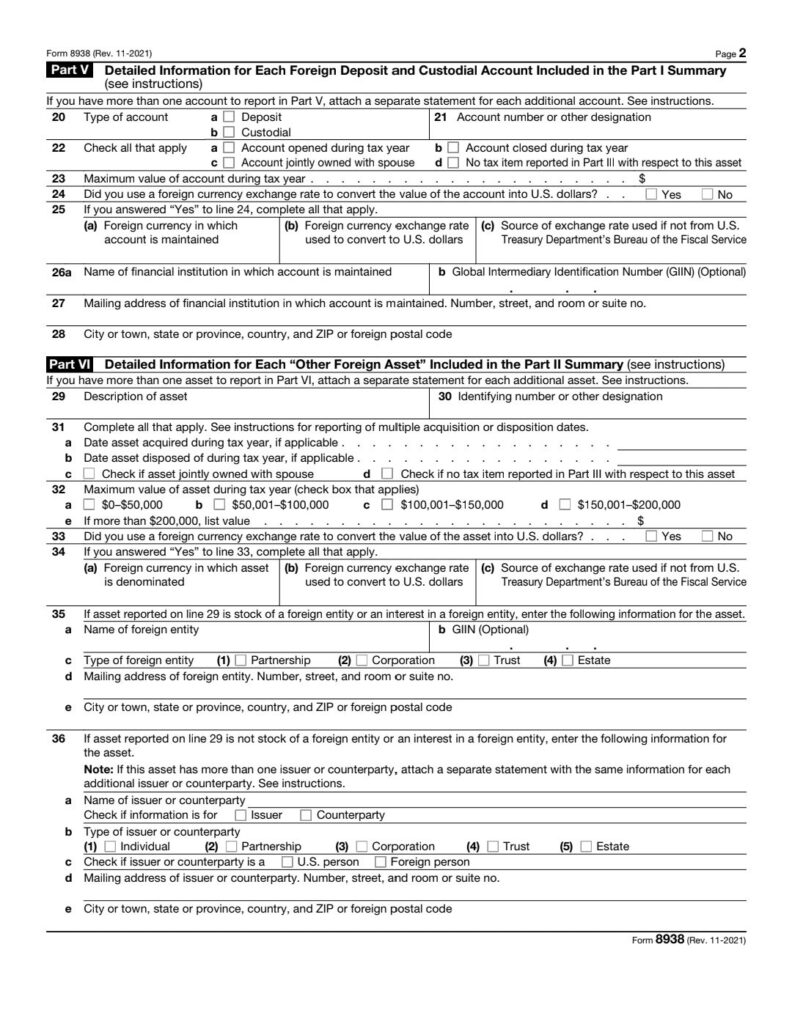

Statement of Specified Foreign Financial Assets

With the increasing globalization of financial markets, IRS Form 8938 has become a crucial requirement for U.S. taxpayers holding foreign financial assets. Here’s everything you need to know:

What is Form 8938?

Form 8938 is a reporting requirement under FATCA (Foreign Account Tax Compliance Act). It ensures that taxpayers disclose certain foreign financial assets, helping the IRS combat offshore tax evasion.

Who Must File?

You are required to file Form 8938 if you are a U.S. taxpayer and your specified foreign financial assets exceed the following thresholds:

1. For individuals living in the U.S.:

Single or Married Filing Separately: $50,000 on the last day of the tax year or $75,000 at any time during the year.

Married Filing Jointly: $100,000 on the last day of the tax year or $150,000 at any time during the year.

2. For individuals living abroad:

Single or Married Filing Separately: $200,000 on the last day of the tax year or $300,000 at any time during the year.

Married Filing Jointly: $400,000 on the last day of the tax year or $600,000 at any time during the year.

What Are Specified Foreign Financial Assets?

These include:

Foreign financial accounts (bank accounts, brokerage accounts, etc.).

Foreign financial instruments and contracts.

Foreign entities (if you have an interest in foreign corporations, partnerships, or trusts).

Key Considerations

Overlap with FBAR: While both Form 8938 and FBAR (FinCEN Form 114) require reporting of foreign accounts, they serve different purposes and have separate filing requirements.

Filing Thresholds: Unlike FBAR, Form 8938 has higher thresholds, and not all foreign financial accounts may be reportable under it.

Penalties for Non-Compliance: Failure to file can result in penalties starting at $10,000, with additional penalties for continued non-compliance, up to $50,000. In cases of willful neglect, criminal penalties may apply.

Filing Method: Form 8938 is filed with your income tax return (Form 1040).

Why This Matters

Non-compliance with FATCA regulations can have severe consequences, both financial and legal. Consulting with a qualified tax professional ensures accurate reporting and peace of mind.

If you’re navigating the complexities of international tax reporting or need assistance with Form 8938, let’s connect and I will simplify your compliance journey!