Qualified Business Income Deduction

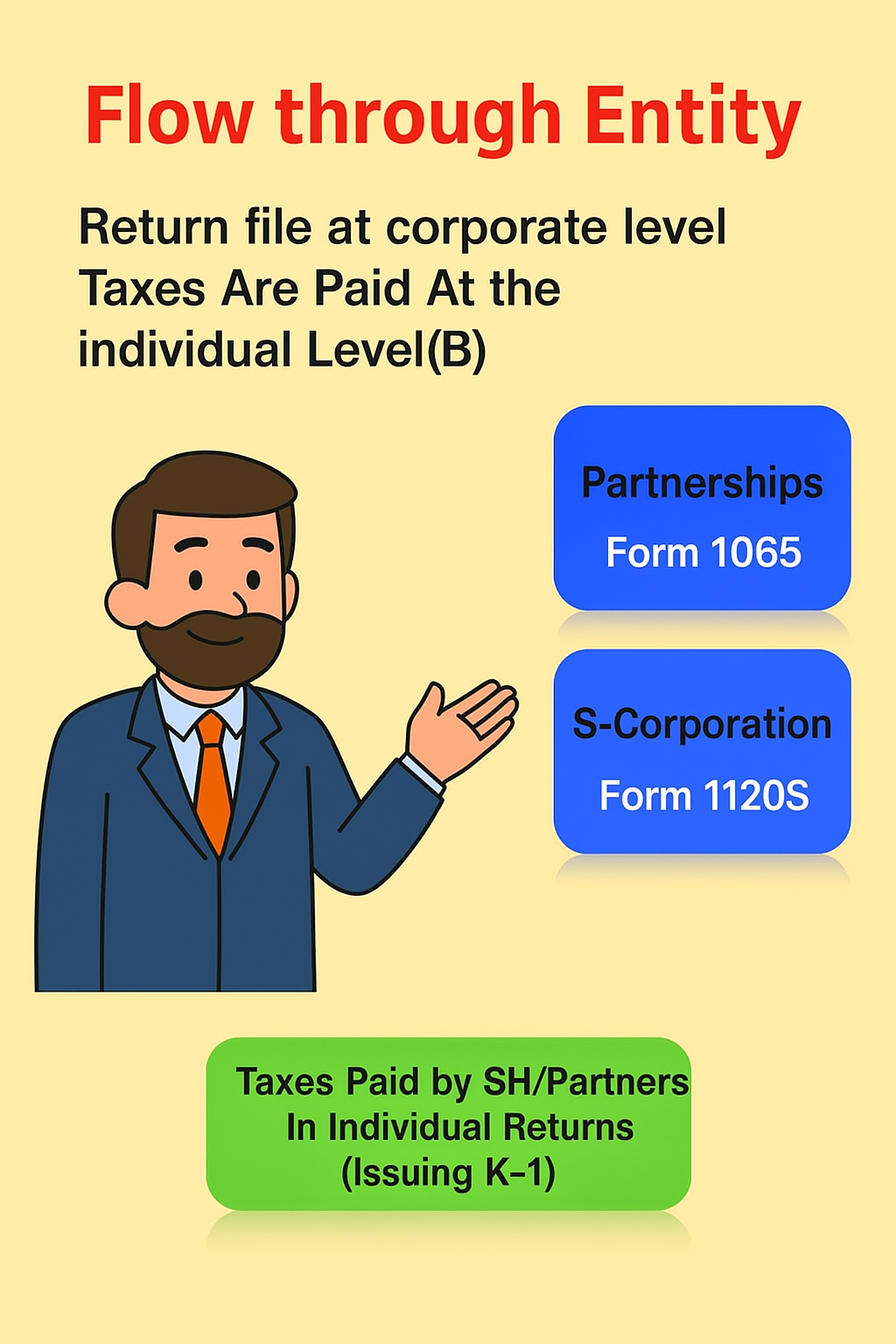

Qualified Business Income (QBI) was introduced as part of the Tax Cuts and Jobs Act (TCJA), which was signed into law on December 22, 2017 and will remain valid till the end of 2025 unless extended or modified through legislation. TCJA included several provisions that benefited larger corporations and small businesses alike. It lowered the corporate tax rate from a maximum of 35% to 21% & helped small businesses in shape of QBI. Non-corporate taxpayers are permitted to claim a 20% deduction for income derived through qualified trades or businesses. The deduction is available to individuals who operate qualified businesses as sole proprietorships or through pass-through entities, including partnerships, LLCs and Subchapter S corporations.

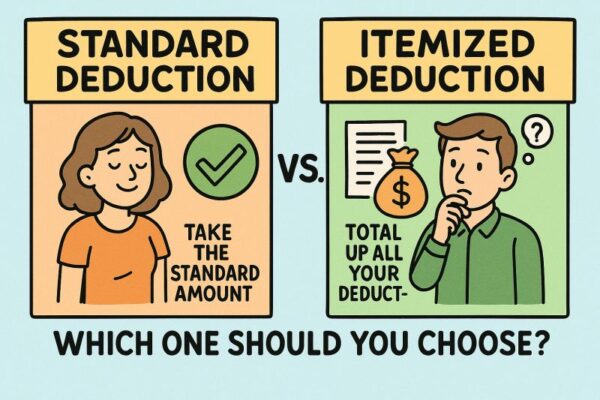

The QBI deduction is taken “Below the line” rather than in computing adjusted taxable income “above the line”. The deduction may thus be claimed whether the taxpayer itemizes deductions or claims the standard deduction

Who qualifies for QBI:

The QBI deduction is claimed with reference to the qualified business income from each specified trade or business. QBI is pivotal in determining the deduction available under Section 199A of the Internal Revenue Code, which allows eligible taxpayers to deduct up to 20% of their QBI.

Wage and Qualified Property Limitation (WQP):

The WQP limitation comes into play for taxpayers with QBI, particularly for high-income earners. This limitation is designed to phase out or limit the QBI deduction based on the amount of W-2 wages paid and the value of qualified property held by the business.

Why WQP is important:

The WQP limitation helps prevent high-income individuals from abusing the QBI deduction by ensuring that only those with substantial investments in their businesses can benefit fully. It incentivizes businesses to hire employees and invest in property, as the deduction is tied to wages and property.

The phase in range for the most recent years is; For 2024, the threshold amount is USD 383,900 for married individuals who file a joint tax return, USD 191,950 for all other individuals