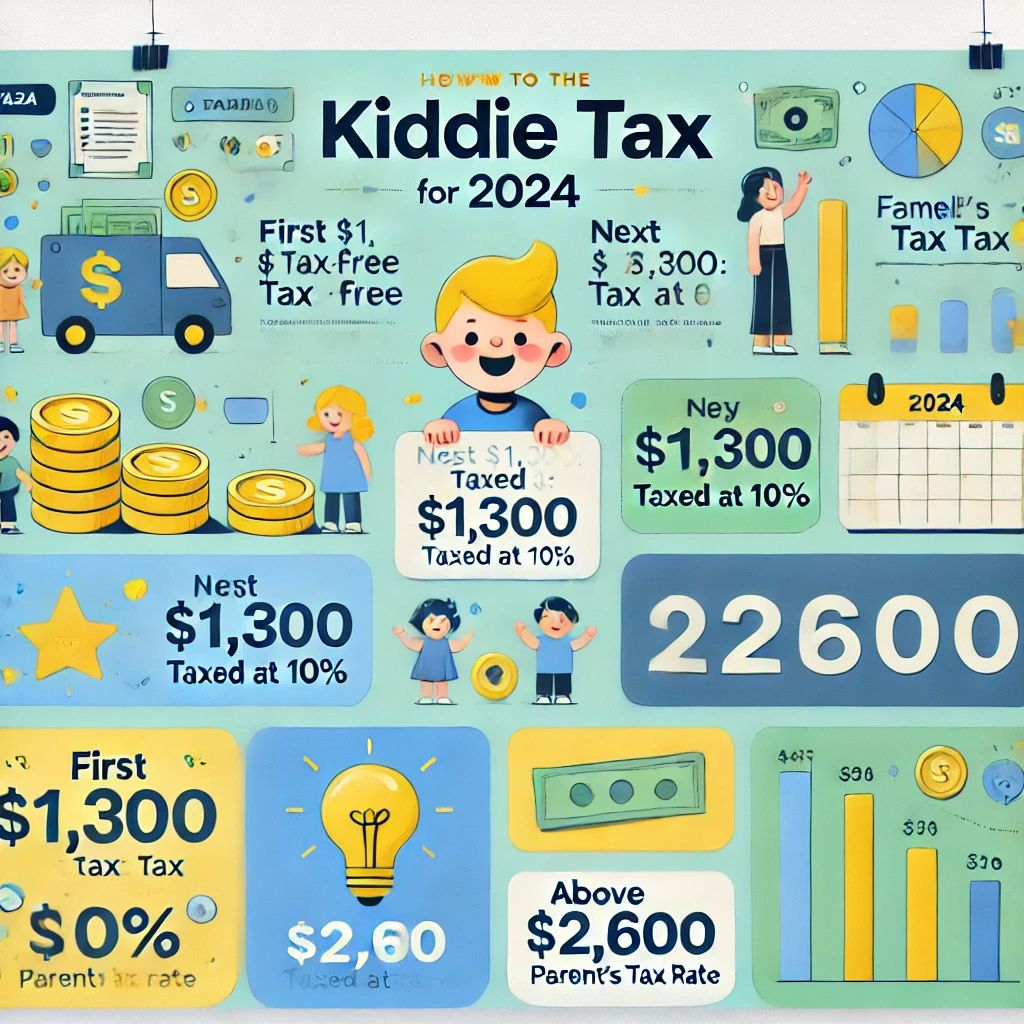

Understanding the Kiddie Tax for 2024: How It Affects Your Child’s Investment Income

As tax season approaches, it’s important to understand how the Kiddie Tax impacts children with investment income. The Kiddie Tax was introduced to prevent parents from shifting investment income to their children to take advantage of lower tax rates. Here’s a quick breakdown of how it works for the 2024 tax year and how it may affect your family.

✨ What is the Kiddie Tax?

The Kiddie Tax applies to unearned income (such as dividends, interest, and capital gains) earned by children:

🟢 Under the age of 18.

🟢 Aged 18-23, if they are full-time students.

Kiddie Tax Thresholds for 2024:

1️⃣ First $1,300 of unearned income: Taxed at 0% (covered by the standard deduction for dependents).

2️⃣ Next $1,300 of unearned income: Taxed at the child’s own tax rate (usually 10%).

3️⃣ Unearned income above $2,600: Taxed at the parents’ tax rate (up to 37%).

Example Calculation

Let’s say your child is 16 years old and has earned $4,000 in dividends from their investments in 2024:

The first $1,300 of income is not taxed (due to the standard deduction for dependents).

The next $1,300 is taxed at the child’s tax rate (e.g., 10%).

The remaining $1,400 ($4,000 – $2,600) is taxed at the parents’ marginal tax rate, which could be higher depending on their income.

While your child pays a small amount of tax on the first $2,600, the remaining income could be taxed at a significantly higher rate, potentially reducing the benefits of investing in your child’s name.

🗂 When Does Your Child Need to File a Tax Return?

If your child’s unearned income exceeds $2,600 in 2024:

A tax return must be filed.

They may need to complete Form 8615 to calculate taxes at the parents’ tax rate.

Pro Tip: Parents can include their child’s unearned income on their own tax return (using Form 8814) if it’s less than $13,000 and consists only of interest and dividends. However, this may increase the parents’ tax liability.

💡 Ways to Reduce Kiddie Tax Liability

Encourage Earned Income: Unearned income is subject to the Kiddie Tax, but earned income (from a part-time job, for example) is not.

📈 Use Tax-Advantaged Accounts: Encourage contributions to Roth IRAs or other tax-advantaged accounts for tax-free growth, avoiding the Kiddie Tax altogether.

📝 Conclusion

While the Kiddie Tax can increase the tax rate on your child’s investment income, understanding the rules and planning effectively can help minimize the tax burden. Consult with a tax professional to assess your family’s situation and explore ways to save on taxes.