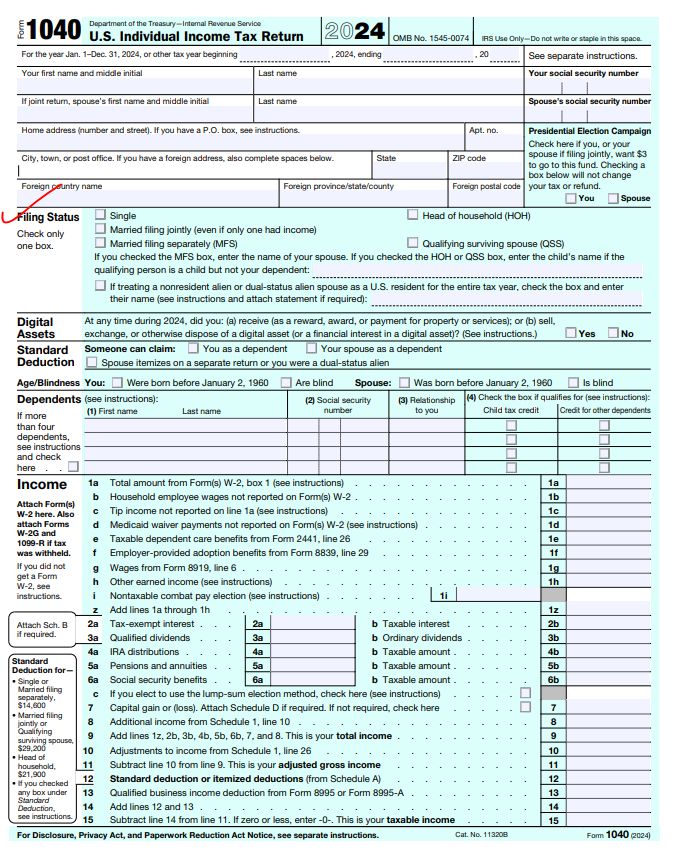

𝙐𝙣𝙙𝙚𝙧𝙨𝙩𝙖𝙣𝙙𝙞𝙣𝙜 𝙔𝙤𝙪𝙧 𝙁𝙞𝙡𝙞𝙣𝙜 𝙎𝙩𝙖𝙩𝙪𝙨 𝙛𝙤𝙧 𝙁𝙤𝙧𝙢 𝟭𝟬𝟰𝟬:

𝙐𝙣𝙙𝙚𝙧𝙨𝙩𝙖𝙣𝙙𝙞𝙣𝙜 𝙔𝙤𝙪𝙧 𝙁𝙞𝙡𝙞𝙣𝙜 𝙎𝙩𝙖𝙩𝙪𝙨 𝙛𝙤𝙧 𝙁𝙤𝙧𝙢 𝟭𝟬𝟰𝟬:

When it comes to filing your taxes, choosing the right filing status is crucial as it directly impacts your tax rate, deductions, and potential credits. The IRS offers five different filing statuses, each with its own requirements and benefits. In this post, I’ll break down each status in simple terms to help you determine which one applies to your situation and ensure you file your taxes in the most efficient way possible.

𝟭. 𝗦𝗶𝗻𝗴𝗹𝗲:

𝘞𝘩𝘰?: People who are not married, legally separated, or widowed before 2024.

𝘛𝘢𝘹 𝘉𝘦𝘯𝘦𝘧𝘪𝘵𝘴: Generally higher taxes compared to others.

𝘋𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵𝘴: Can claim dependents, but it often results in higher tax.

𝘒𝘦𝘺 𝘗𝘰𝘪𝘯𝘵: For those who don’t qualify for any other filing status.

𝟮. 𝗛𝗲𝗮𝗱 𝗼𝗳 𝗛𝗼𝘂𝘀𝗲𝗵𝗼𝗹𝗱 (𝗛𝗢𝗛):

𝘞𝘩𝘰?: Unmarried or considered unmarried, and you pay more than half the cost of keeping a home for a dependent (like a child).

𝘛𝘢𝘹 𝘉𝘦𝘯𝘦𝘧𝘪𝘵𝘴: Lower taxes than Single, with higher deductions.

𝘋𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵𝘴: Must have a dependent living with you (e.g., child or parent).

𝘒𝘦𝘺 𝘗𝘰𝘪𝘯𝘵: You must meet specific rules to qualify, like living apart from a spouse.

𝟯. 𝗠𝗮𝗿𝗿𝗶𝗲𝗱 𝗙𝗶𝗹𝗶𝗻𝗴 𝗝𝗼𝗶𝗻𝘁𝗹𝘆 (𝗠𝗙𝗝):

𝘞𝘩𝘰?: Married couples who file together, combining their incomes and deductions.

𝘛𝘢𝘹 𝘉𝘦𝘯𝘦𝘧𝘪𝘵𝘴: Lowest tax rates and highest deductions.

𝘋𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵𝘴: Both spouses can claim dependents together.

𝘒𝘦𝘺 𝘗𝘰𝘪𝘯𝘵: Both spouses share responsibility for taxes, but it offers significant savings.

𝟰. 𝗠𝗮𝗿𝗿𝗶𝗲𝗱 𝗙𝗶𝗹𝗶𝗻𝗴 𝗦𝗲𝗽𝗮𝗿𝗮𝘁𝗲𝗹𝘆 (𝗠𝗙𝗦):

𝘞𝘩𝘰?: Married couples who choose to file separately.

𝘛𝘢𝘹 𝘉𝘦𝘯𝘦𝘧𝘪𝘵𝘴: Higher taxes and fewer deductions.

𝘋𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵𝘴: Can claim dependents, but many tax benefits are limited.

𝘒𝘦𝘺 𝘗𝘰𝘪𝘯𝘵: This is usually less beneficial tax-wise but may be useful if you want to avoid sharing tax responsibility with your spouse.

𝟱. 𝗤𝘂𝗮𝗹𝗶𝗳𝘆𝗶𝗻𝗴 𝗦𝘂𝗿𝘃𝗶𝘃𝗶𝗻𝗴 𝗦𝗽𝗼𝘂𝘀𝗲 (𝗤𝗦𝗦):

𝘞𝘩𝘰?: Widowed in 2022 or 2023, with a dependent child living with you, and not remarried by the end of 2024.

𝘛𝘢𝘹 𝘉𝘦𝘯𝘦𝘧𝘪𝘵𝘴: Same tax benefits as Married Filing Jointly.

𝘋𝘦𝘱𝘦𝘯𝘥𝘦𝘯𝘵𝘴: Must have a dependent child living with you.

𝘒𝘦𝘺 𝘗𝘰𝘪𝘯𝘵: You can file as if you’re still married for up to two years after your spouse’s death (if no remarriage).