Understanding Tax Benefits: Deductions vs. Credits

What Are Tax Deductions?

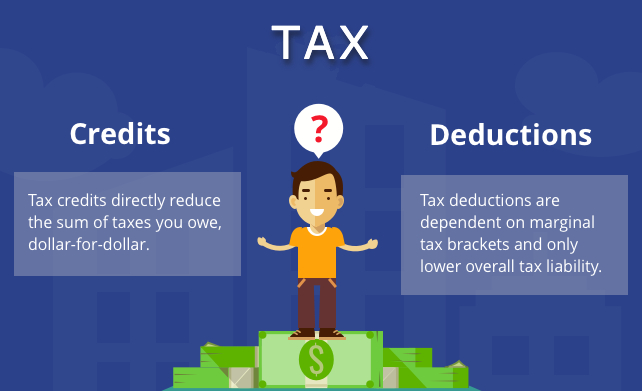

A tax deduction reduces your taxable income, which in turn lowers the amount of tax you owe. Think of it as a way to shrink the portion of your income that is subject to taxation.

For example: If you earn $50,000 a year and claim a $5,000 deduction, your taxable income becomes $45,000. Assuming a tax rate of 20%, this deduction would save you $1,000 in taxes.

Common deductions include:

-Mortgage interest

-Charitable contributions

-Medical expenses (if they exceed a certain percentage of your income)

-Student loan interest

What Are Tax Credits?

A tax credit, on the other hand, directly reduces your tax liability. It’s a dollar-for-dollar reduction in the amount of taxes you owe.

For example: If you owe $2,000 in taxes and qualify for a $500 tax credit, your tax bill drops to $1,500.

There are two types of credits:

1) Non-refundable credits: These can reduce your tax liability to zero but won’t result in a refund. Examples include the Child and Dependent Care Credit and Lifetime Learning Credit.

2) Refundable credits: These can reduce your tax liability below zero, resulting in a refund. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

Deductions vs. Credits: Which is Better?

To determine whether deductions or credits are better, you need to understand how they impact your taxes.

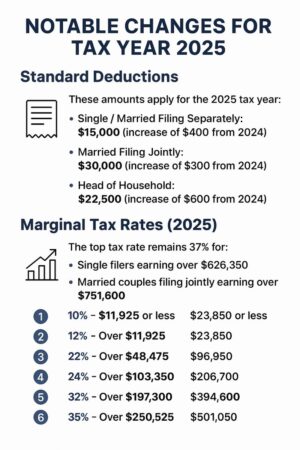

1. Impact on Tax Liability

Deductions: Reduce your taxable income, which means the benefit depends on your marginal tax rate. For example, a $1,000 deduction saves $200 for someone in the 20% tax bracket but only $100 for someone in the 10% bracket.

Credits: Directly reduce the tax you owe, offering equal value to all taxpayers. A $1,000 credit saves $1,000 regardless of income.

2. Simplicity

Tax credits are often more straightforward. The dollar value of a credit doesn’t change based on your income, making it easier to calculate the benefit.

3. Refundability

Refundable credits provide a unique advantage over deductions because they can result in a refund even if you owe no taxes. For lower-income taxpayers, refundable credits can be particularly valuable.

When to Choose Deductions

If you’re in a high tax bracket, deductions can provide significant savings.

If you have substantial eligible expenses (e.g., medical bills, charitable donations), deductions might be more advantageous.

When to Opt for Credits

If you’re looking for a dollar-for-dollar reduction in taxes owed, credits are usually the better choice. Refundable credits are ideal if you’re eligible, especially if your tax liability is low.

Can You Use Both?

Yes! In many cases, you can claim both deductions and credits, maximizing your tax savings.

For example: Deducting student loan interest while also claiming the American Opportunity Tax Credit (AOTC) for education expenses.