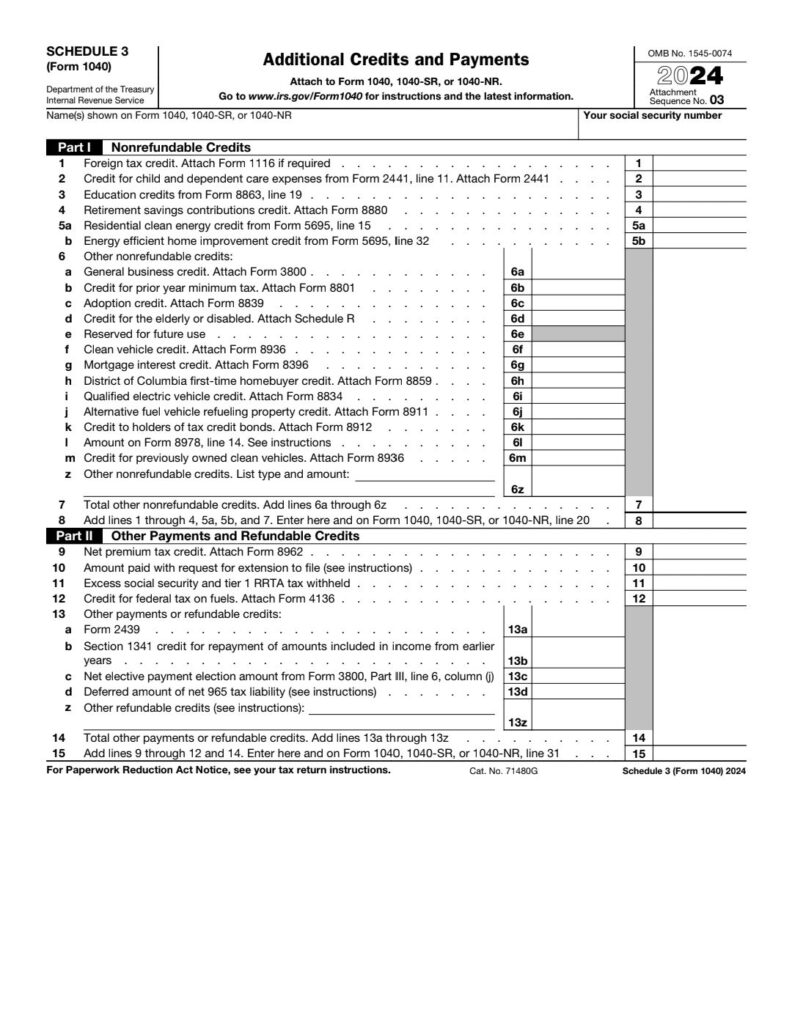

Deep Dive into Form 1040 Schedule 3: Credits and Payments

For tax professionals and taxpayers alike, Schedule 3 of Form 1040 is a critical component of the U.S. individual income tax return. It covers nonrefundable credits, refundable credits, and additional payments, which can significantly affect a taxpayer’s final tax liability or refund.

📋 What is Form 1040 Schedule 3?

Schedule 3 is an attachment to Form 1040, used to report tax credits and payments that aren’t listed directly on the main form. It ensures taxpayers can claim their eligible credits and payments accurately.

📝 Sections of Schedule 3

1️⃣ Part I: Nonrefundable Credits

These credits reduce your tax liability but cannot result in a refund if they exceed the amount of taxes owed. Examples include:

Credit for Child and Dependent Care Expenses (Form 2441)

Education Credits (American Opportunity and Lifetime Learning, reported on Form 8863)

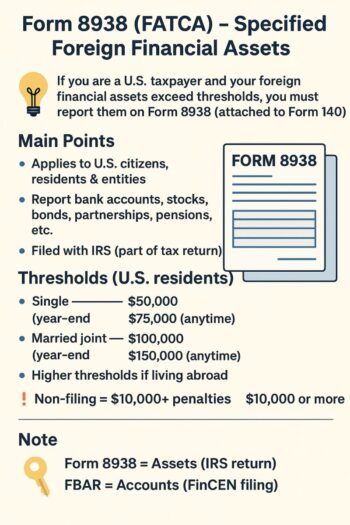

Foreign Tax Credit (Form 1116 or 1040 instructions)

General Business Credit (Form 3800)

Other less common credits like the Adoption Credit.

2️⃣ Part II: Other Payments and Refundable Credits

Refundable credits can result in a refund even if no taxes are owed. This section also includes additional payments applied toward taxes. Examples:

Net Premium Tax Credit (Form 8962)

Earned Income Tax Credit (EITC)

Additional Child Tax Credit (part of Form 8812)

Amount paid with an extension to file (Form 4868)

💡 Why is Schedule 3 Important?

It helps taxpayers maximize their tax savings by claiming eligible credits.

Ensures compliance with IRS regulations by accurately reporting payments and credits.

Plays a key role in reducing the tax burden or increasing refunds.

🔍 Who Should File Schedule 3?

You should file Schedule 3 if you’re eligible for credits or payments that aren’t covered directly on Form 1040 or Schedule 2.

Taxpayers with educational expenses, childcare expenses, foreign taxes paid, or refundable credits like the Earned Income Credit should review this schedule carefully.

💼 As Tax Professionals

It’s our responsibility to guide clients through these forms, ensuring they’re taking full advantage of all available credits and making accurate payments.

Have questions about Schedule 3 or other tax forms? Let’s discuss how we can simplify the complexities of tax planning and preparation!