A Comprehensive Guide to Form 1040 Schedule 1

A Comprehensive Guide to Form 1040 Schedule 1

Form 1040 Schedule 1 is a supplemental form used to report specific types of additional income and adjustments to income that are not included directly on the main Form 1040. Filing this form is essential for taxpayers who have income or deductions falling into specific categories.

Purpose of Schedule 1

It serves two primary functions:

1. Reporting Additional Income: This includes income sources beyond wages, salaries, and standard investments.

2. Claiming Adjustments to Income: These adjustments reduce taxable income, helping to lower the overall tax liability.

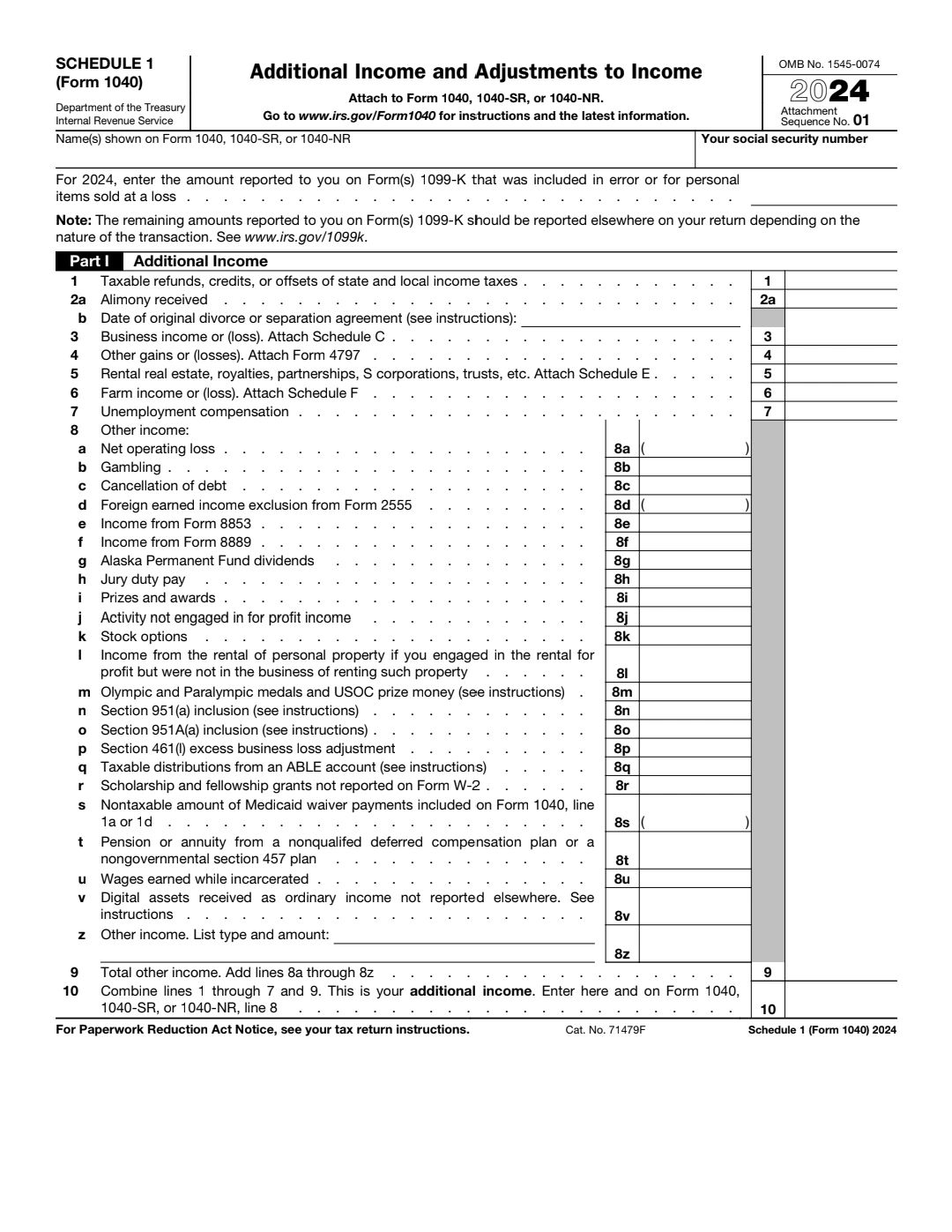

Part I: Additional Income

Report income that isn’t captured directly on Form 1040. Common examples include:

1. Taxable Refunds, Credits, or Offsets of State and Local Income Taxes

If you received a refund from state/local taxes and deducted these taxes in a prior year.

2. Alimony Received (for divorce agreements finalized before 2019).

3. Business Income or Loss

Includes income reported from sole proprietorships (Schedule C).

4. Capital Gains or Losses

Derived from selling investments like stocks or property.

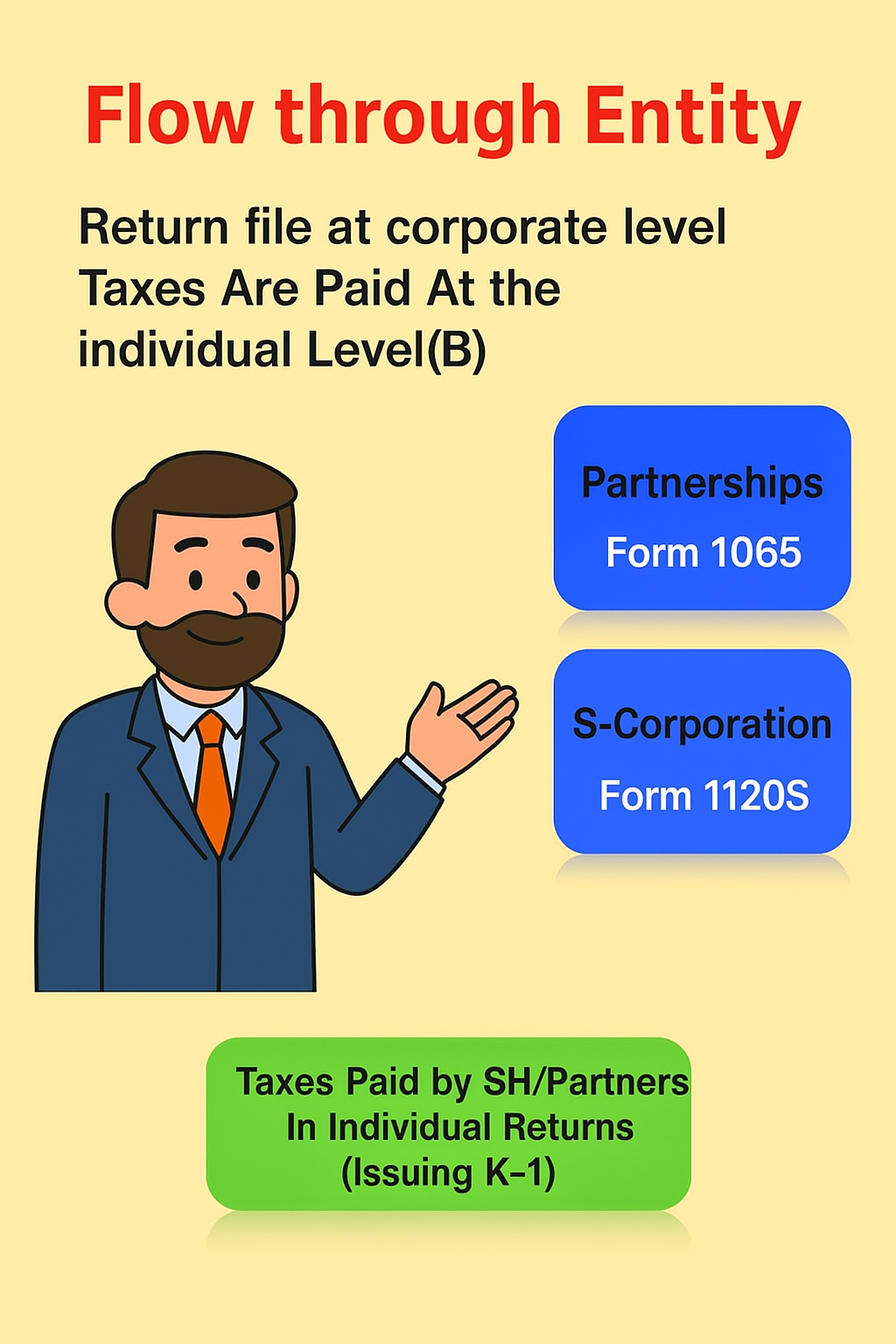

5. Rental Real Estate, Royalties, Partnerships, etc.

Includes income reported on Schedule E.

6. Unemployment Compensation

Benefits received while unemployed.

7. Other Income

Jury duty pay, prize money, gambling winnings, or any miscellaneous income.

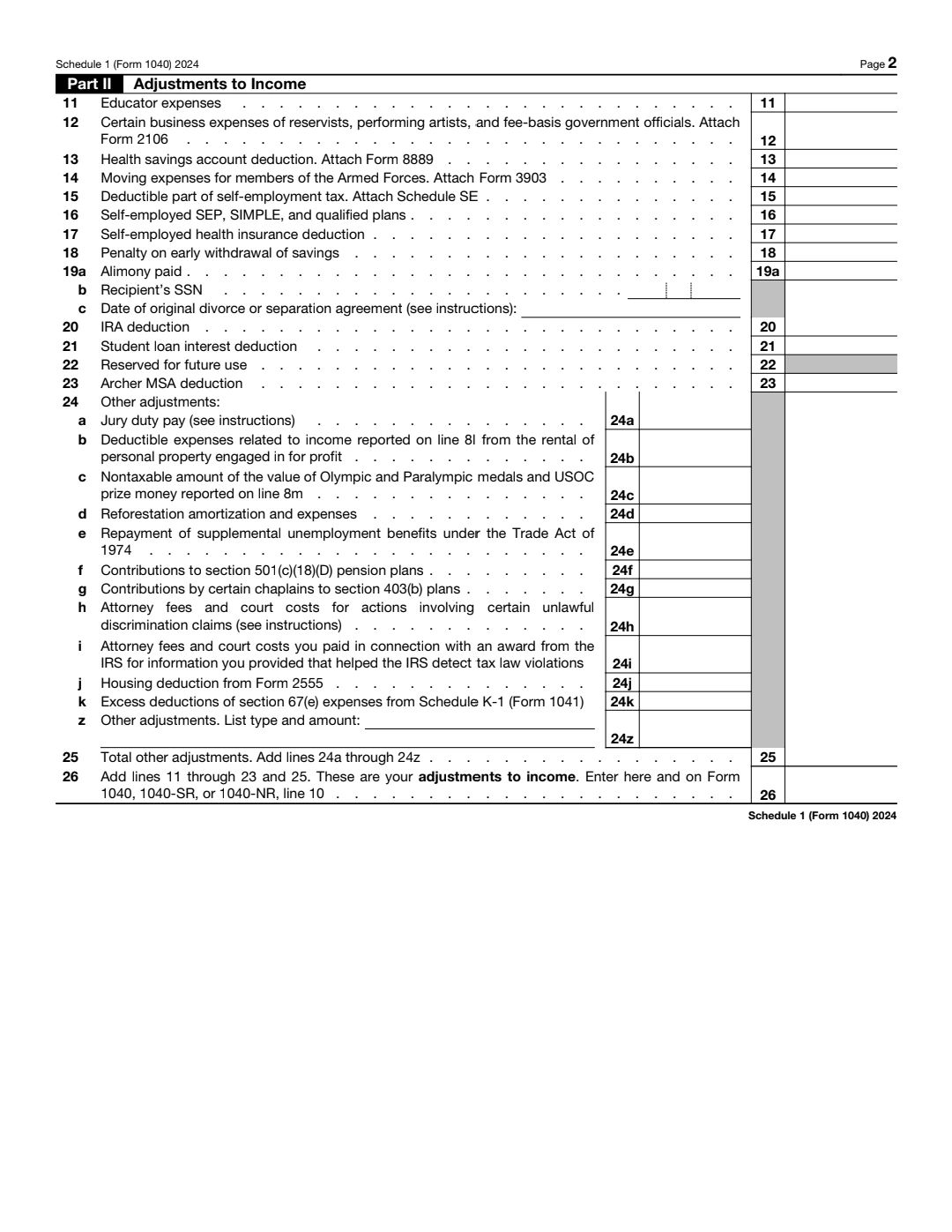

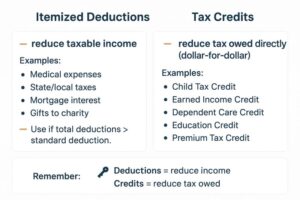

Part II: Adjustments to Income

Claim deductions to reduce your adjusted gross income (AGI), such as:

1. Educator Expenses

Up to $300 for qualified expenses incurred by eligible teachers.

2. Health Savings Account (HSA) Contributions

Contributions to an HSA account, subject to IRS limits.

3. Self-Employment Tax Deduction

Deduct half of the self-employment tax paid.

4. IRA Contributions

Deductible contributions to a traditional IRA.

5. Student Loan Interest Deduction

Up to $2,500 of interest paid on qualified student loans.

6. Alimony Paid

For agreements finalized before 2019.

7. Other Deductions

Penalty on early withdrawal of savings, qualified performing artist deductions, etc.

Who Needs to File Schedule 1?

You must file Schedule 1 if you:

Have income from sources like business, rental property, or gambling winnings.

Need to claim adjustments such as IRA contributions or student loan interest deductions.

Want to report income or deductions not included on Form 1040.

Key Considerations

Accuracy: Ensure all amounts match your supporting documents (e.g., W-2s, 1099s).

Recordkeeping: Keep detailed records of income and adjustments for IRS verification.

By understanding Form 1040 Schedule 1, taxpayers can ensure compliance and take advantage of deductions to reduce their taxable income.

If you’re navigating complex tax situations, consulting a tax professional can make a significant difference!