The OBBBA timeline

The OBBBA timeline, powered by the AICPA — a great cheat sheet for the key provisions and when they take effect.

The OBBBA timeline, powered by the AICPA — a great cheat sheet for the key provisions and when they take effect.

Many high-income taxpayers don’t realize that ignoring the Alternative Minimum Tax (AMT) can significantly increase their tax liability. Here’s a real-world style example: *Without planning, the taxpayer owed $85,424 under AMT. *With proper planning, liability was reduced to $69,850 — a tax savings of $15,574. This case study breaks down: * Regular Tax Calculation *…

*1098 → Mortgage interest, real estate taxes *1098-E → Student loan interest *1098-T → Tuition & education expenses *Schedule A → Itemized deductions (medical, mortgage, taxes, charity, etc.) *Schedule C → Business expenses (for self-employed) *Schedule E → Rental property expenses *Schedule F → Farm expenses *Form 2441 → Child & dependent care expenses (credit)…

The Form 1040, officially called the U.S. Individual Income Tax Return, is the standard federal income tax form used by most taxpayers in the United States. It’s issued by the Internal Revenue Service (IRS) and must be filed annually by individuals to report their income, claim tax deductions and credits, and calculate the amount of…

Have you ever had a client mention a 1031 exchange after it’s already happened? Or discovered a 1031 in last year’s workpapers with zero heads-up? I break down the essentials of §1031 like-kind exchanges: what they are, what they are not, and how to handle them when they land in your tax prep queue. Key…

Last week, while reviewing a client’s books, I noticed something surprising. For several years, the company had been carrying intangible assets on the balance sheet… but no amortization was ever recorded. The client’s first reaction: “Can we go back and amend all those returns?”Here’s the reality:1. The IRS does not require amending prior returns just…

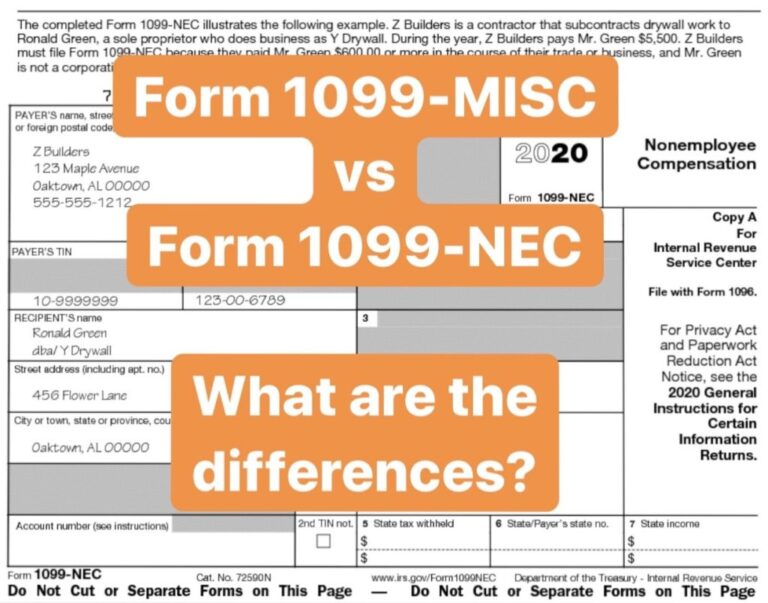

Both forms are used to report non-wage payments, but they serve different purposes after the IRS split reporting in 2020. 🔍 Form 1099-MISC – Miscellaneous Information 🔍 Form 1099-NEC – Nonemployee Compensation 📊 Form 1099-MISC vs. Form 1099-NEC – Key Differences 🔹 Purpose *1099-MISC → Reports miscellaneous payments (rent, royalties, prizes, legal settlements, etc.) *1099-NEC…

Form 1099-G is issued by federal, state, or local governments to taxpayers who received certain types of government payments during the year. It helps ensure that individuals report these amounts as income when filing their Form 1040 (U.S. Individual Income Tax Return). 🔹 Common Situations Where You Receive Form 1099-G 1. Unemployment Compensation – If…

orm W-2 is an IRS tax form that employers must provide to employees each year. It reports the employee’s annual wages and the taxes withheld from their paycheck . 🔍 Key Points 1️⃣ Who issues it? • Employers send it to both the employee and the IRS. 2️⃣ Who receives it? • All employees (not…

While observing a partnership return (Form 1065), I came across an interesting twist: 👤 Partner A: 95% 👤 Partner B: 5% 📅 This year, Partner B exited the business… and Partner A took full control (100%). Now here’s where it got tax-technical — and fun to learn! 🔍 What changed on the return? ✅ Profit/Loss?…