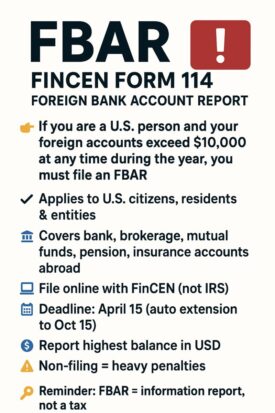

FBAR (FinCEN Form 114) – Foreign Bank Account Report

💡 FBAR (FinCEN Form 114) – Foreign Bank Account Report :-

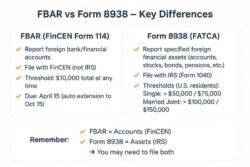

If you are a U.S. person and your total foreign bank/financial accounts exceed $10,000 at any time during the year, you must file an FBAR.

📌 Easy-to-understand points:

*Applies to all U.S. citizens, residents, and entities (LLCs, Corps, Trusts).

*Includes bank, brokerage, mutual funds, pension, insurance accounts outside the U.S.

*File online with FinCEN (not IRS).

*Deadline: April 15 (automatic extension to Oct 15).

*Report the highest balance (converted to USD).

*Non-filing = heavy penalties (even if no tax is due).

✅ Example:

National Bank (Pakistan): $5,000

ICICI Bank (India): $5,001

👉 Total = $10,001 → FBAR filing required.

🔑 Remember: FBAR is an information report, not a tax. The goal is transparency of offshore accounts.