US Payroll – Step 5: Timekeeping & Gross Pay Calculation

💼US Payroll – Step 5: Timekeeping & Gross Pay Calculation: –

1️⃣ Collect Time Data – Get timesheets/timecards for hourly staff or confirm salaries.

👉 Example: Hourly employee logs 45 hours; salaried employee gets fixed pay.

2️⃣ Calculate Gross Pay – Hours × Rate + Bonuses + Commissions + Taxable Reimbursements.

👉 Example: 40 hrs × $20 = $800 + $50 bonus = $850 gross pay.

3️⃣ Overtime Pay – 1.5× regular rate for hours over 40/week (per FLSA).

👉 Example: 5 overtime hrs × $30 = $150 extra.

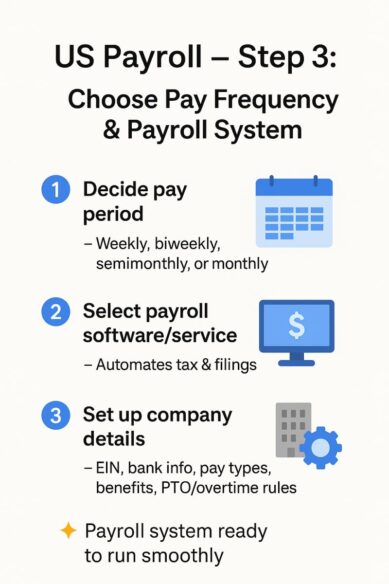

4️⃣ Pay Frequency (as per US payroll standards):-

1) Weekly: 52 pay periods per year (≈ 40 hrs/week)

2) Biweekly: 26 pay periods per year (≈ 80 hrs every 2 weeks)

3) Semi-monthly: 24 pay periods per year (≈ 86.67 hrs per period)

4) Monthly: 12 pay periods per year (≈ 173.33 hrs per period)

✨ Accurate timekeeping ensures correct pay, overtime, and tax calculations!