Similar Posts

Form 3520 – Transactions with Foreign Trusts

Bytaxtium📋 Form 3520 – Transactions with Foreign Trusts :- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. 📘 Purpose:- Used by U.S. persons (citizens, residents, or entities) to report certain transactions with foreign trusts or receipt of large gifts or inheritances from foreign individuals or entities. 📋 You must…

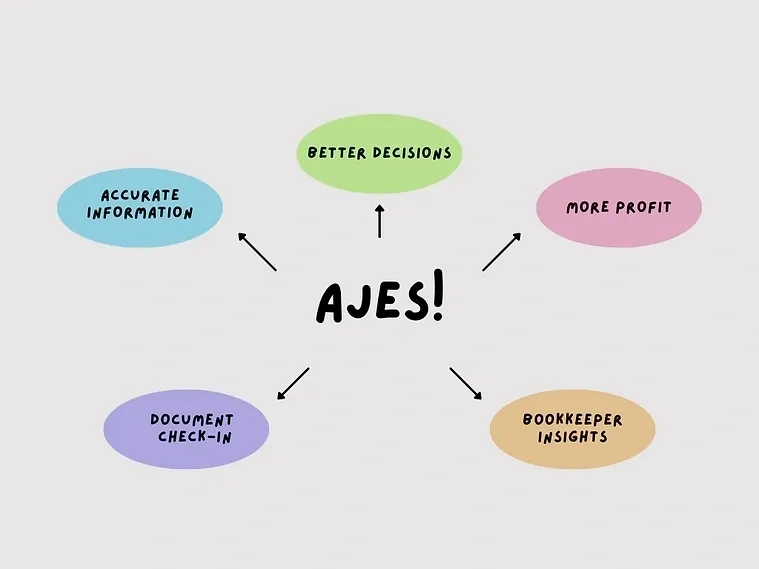

🌟 Why Do We Post AJEs When Preparing US Business Tax Returns? 🌟

Bytaxtium🌟 Why Do We Post AJEs When Preparing US Business Tax Returns? 🌟 Hey friends! 👋 Ever wonder why accountants always talk about AJE (Adjusting Journal Entries) when it’s time to prepare business tax returns in the US? Don’t worry let’s break it down in a simple way! 💡 🔍 What is an AJE? An…

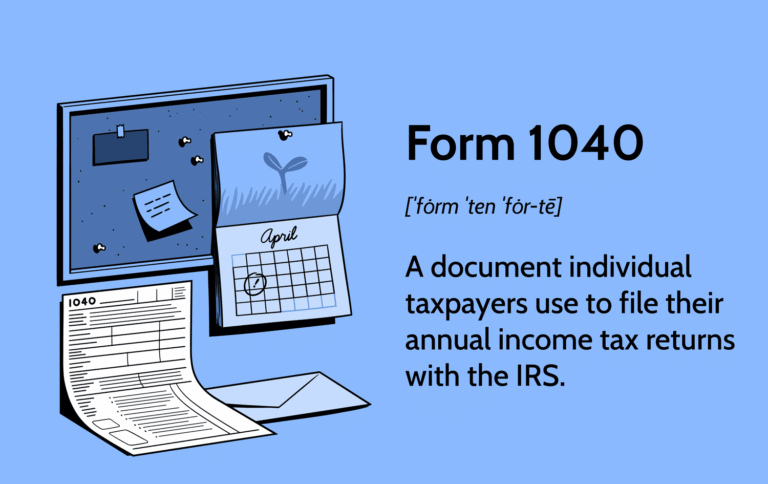

The 1040 form

BytaxtiumThe Form 1040, officially called the U.S. Individual Income Tax Return, is the standard federal income tax form used by most taxpayers in the United States. It’s issued by the Internal Revenue Service (IRS) and must be filed annually by individuals to report their income, claim tax deductions and credits, and calculate the amount of…

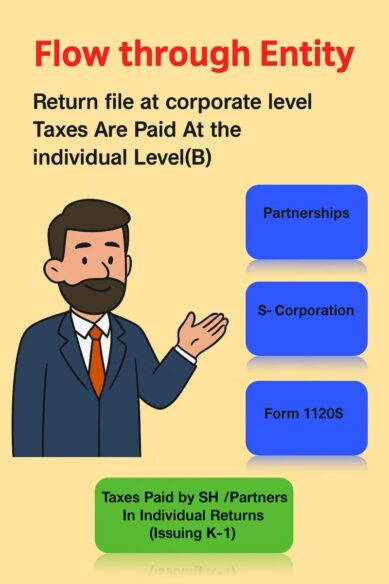

03b – Topic: Taxability – Flow Through Entities

BytaxtiumTopic: Taxability – Flow Through Entities Flow Through Entities play a unique role in taxation. ✅ Entities like Partnerships (Form 1065) and S-Corporations (Form 1120S) file returns at the corporate level. ✅ However, the taxes are paid at the individual level by shareholders or partners. ✅ Income passes through to individuals via Schedule K-1, and…

𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐯𝐬. 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔

Bytaxtium𝐂𝐨𝐧𝐟𝐮𝐬𝐞𝐝 𝐛𝐞𝐭𝐰𝐞𝐞𝐧 𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐚𝐧𝐝 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔? 𝐇𝐞𝐫𝐞’𝐬 𝐚 𝐪𝐮𝐢𝐜𝐤 𝐛𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧 𝐭𝐨 𝐡𝐞𝐥𝐩 𝐲𝐨𝐮 𝐜𝐡𝐨𝐨𝐬𝐞 𝐭𝐡𝐞 𝐛𝐞𝐬𝐭 𝐭𝐚𝐱-𝐬𝐚𝐯𝐢𝐧𝐠 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐰𝐡𝐞𝐧 𝐝𝐞𝐚𝐥𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐢𝐧𝐜𝐨𝐦𝐞. 📌 𝐄𝐥𝐢𝐠𝐢𝐛𝐢𝐥𝐢𝐭𝐲 🔹 Form 2555: Must 𝐥𝐢𝐯𝐞 𝐚𝐧𝐝 𝐰𝐨𝐫𝐤 𝐚𝐛𝐫𝐨𝐚𝐝 (330+ days or bona fide residence). 🔹 Form 1116: No residency needed. Just f𝐨𝐫𝐞𝐢𝐠𝐧-𝐬𝐨𝐮𝐫𝐜𝐞 𝐢𝐧𝐜𝐨𝐦𝐞 𝐚𝐧𝐝 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐭𝐚𝐱𝐞𝐬 𝐩𝐚𝐢𝐝. 📌 𝐈𝐧𝐜𝐨𝐦𝐞…

S-Corporation Election

BytaxtiumHow To File S-Corporation Election The election of S corporation status is made by filing a form called “Election by a Small Business Corporation” with the IRS Service Center, where the corporation files its corporate federal income tax return. The election of the S corporation status must be unanimously approved by all of the shareholders…