Similar Posts

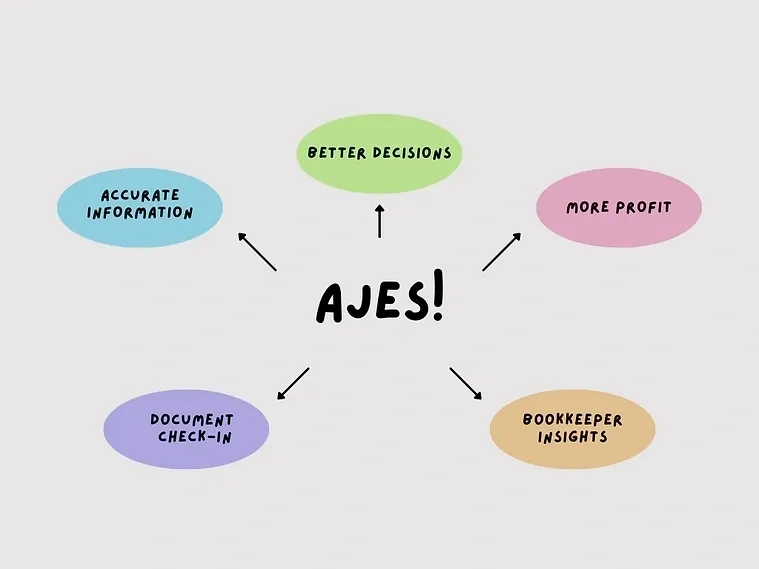

🌟 Why Do We Post AJEs When Preparing US Business Tax Returns? 🌟

Bytaxtium🌟 Why Do We Post AJEs When Preparing US Business Tax Returns? 🌟 Hey friends! 👋 Ever wonder why accountants always talk about AJE (Adjusting Journal Entries) when it’s time to prepare business tax returns in the US? Don’t worry let’s break it down in a simple way! 💡 🔍 What is an AJE? An…

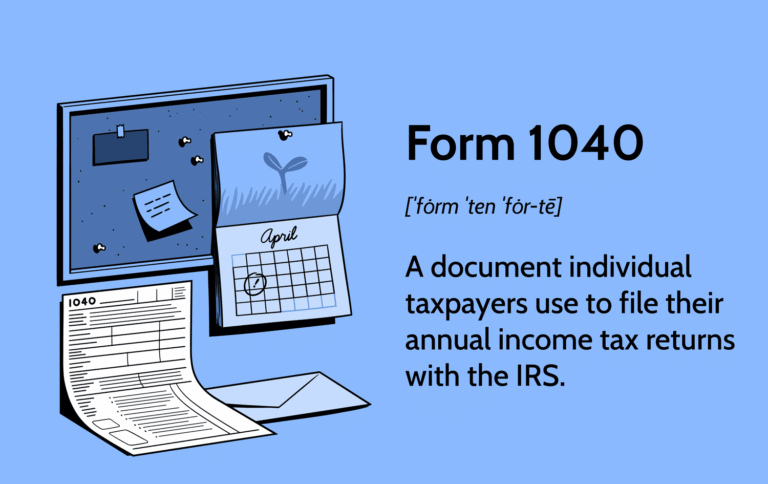

The 1040 form

BytaxtiumThe Form 1040, officially called the U.S. Individual Income Tax Return, is the standard federal income tax form used by most taxpayers in the United States. It’s issued by the Internal Revenue Service (IRS) and must be filed annually by individuals to report their income, claim tax deductions and credits, and calculate the amount of…

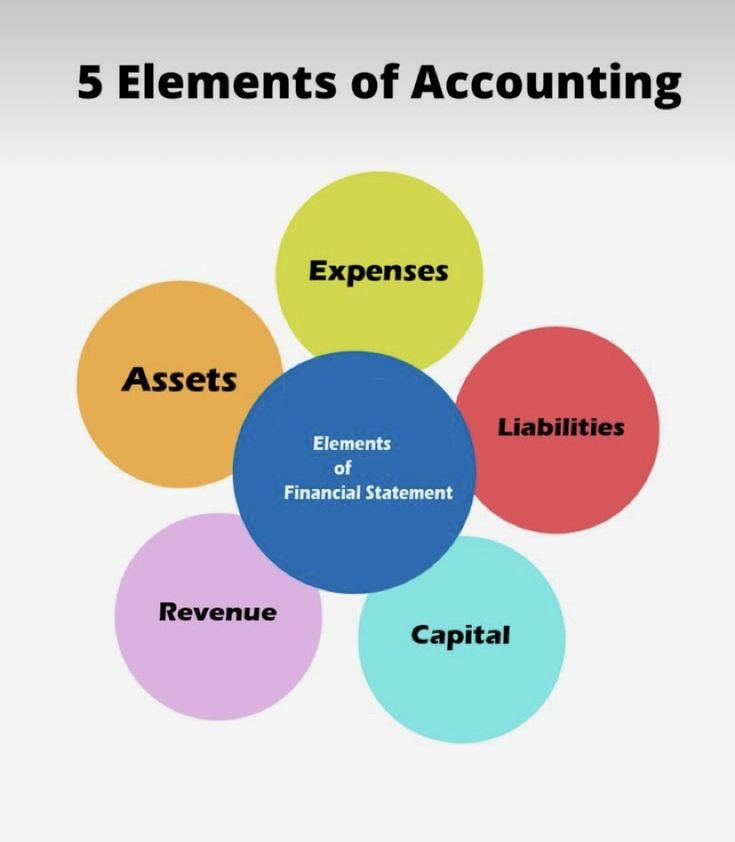

Understanding the 5 Key Elements of Accounting

Bytaxtium5 Major Elements of Accounting Accounting is the language of business, and its foundation rests on five key elements. Mastering these is essential for anyone in finance, management, or entrepreneurship. 1. #Assets Resources owned by a business that provide future economic benefits. Examples: Cash, Inventory, Equipment, Investments 2. #Liabilities Obligations a business owes to outsiders….

Expense / deduction-related forms (flow into Form 1040 Adjustments, Deductions, Credits)

Bytaxtium*1098 → Mortgage interest, real estate taxes *1098-E → Student loan interest *1098-T → Tuition & education expenses *Schedule A → Itemized deductions (medical, mortgage, taxes, charity, etc.) *Schedule C → Business expenses (for self-employed) *Schedule E → Rental property expenses *Schedule F → Farm expenses *Form 2441 → Child & dependent care expenses (credit)…

Form 1099-G – Certain Government Payments (Unemployment Benefits)

BytaxtiumForm 1099-G is issued by federal, state, or local governments to taxpayers who received certain types of government payments during the year. It helps ensure that individuals report these amounts as income when filing their Form 1040 (U.S. Individual Income Tax Return). 🔹 Common Situations Where You Receive Form 1099-G 1. Unemployment Compensation – If…

The OBBBA timeline

BytaxtiumThe OBBBA timeline, powered by the AICPA — a great cheat sheet for the key provisions and when they take effect.