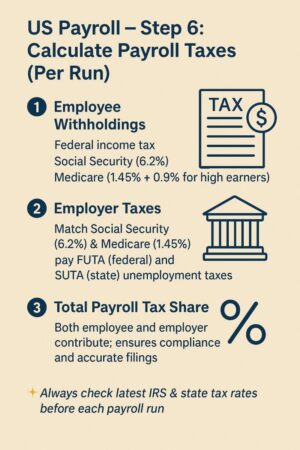

US Payroll – Step 6: Calculate Payroll Taxes (Per Run)

💼 US Payroll – Step 6: Calculate Payroll Taxes (Per Run)

🧾 What It Means:-

Payroll taxes are shared between employees and employers — covering federal income tax, Social Security, Medicare, and unemployment taxes.

Example – just like in India where PF (Provident Fund) has both portions (employees and employers). The only difference in the US, this deduction is for taxes (Social Security & Medicare) instead of PF.

Note: Federal income tax, Social Security, Medicare, and unemployment taxes are not retirement funds — they are taxes.

(The PF example is only for easy understanding of how both employee and employer contribute.)

1️⃣ Employee Withholdings (deducted from employee pay)

*Federal Income Tax – Based on W-4 form selections.

*Social Security – 6.2% (up to annual wage limit).

*Medicare – 1.45% (+0.9% extra for high earners).

👉 Example: $1,000 pay → $62 Social Security + $14.50 Medicare withheld.

2️⃣ Employer Taxes (paid by the employer)

*Social Security (6.2%) + Medicare (1.45%) – Employer matches these amounts.

*FUTA (Federal Unemployment Tax) – Employer only; report on Form 940.

*SUTA (State Unemployment Tax) – Rate varies by state.

👉 Example: Employer pays same 7.65% + unemployment taxes.

✨ Pro Tip: Always check the latest IRS and state tax rates before processing payroll — they change annually!