Similar Posts

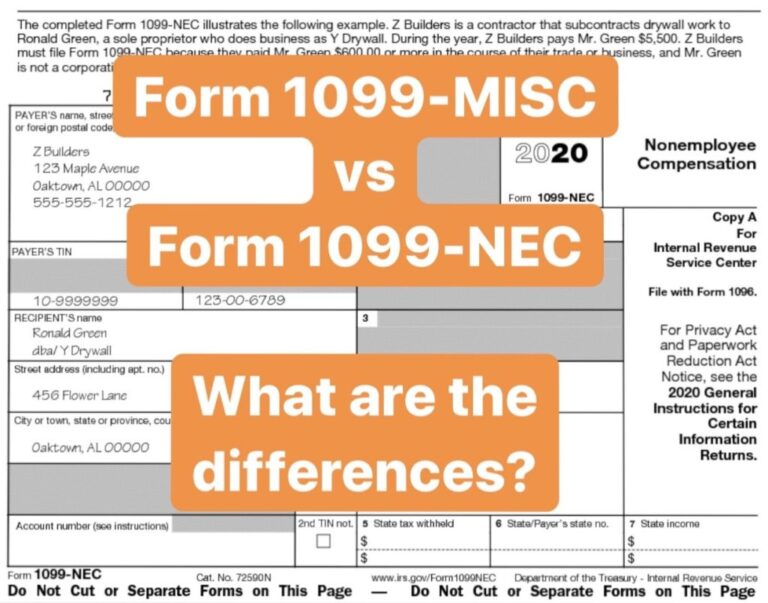

Form 1099-MISC vs. Form 1099-NEC

BytaxtiumBoth forms are used to report non-wage payments, but they serve different purposes after the IRS split reporting in 2020. 🔍 Form 1099-MISC – Miscellaneous Information 🔍 Form 1099-NEC – Nonemployee Compensation 📊 Form 1099-MISC vs. Form 1099-NEC – Key Differences 🔹 Purpose *1099-MISC → Reports miscellaneous payments (rent, royalties, prizes, legal settlements, etc.) *1099-NEC…

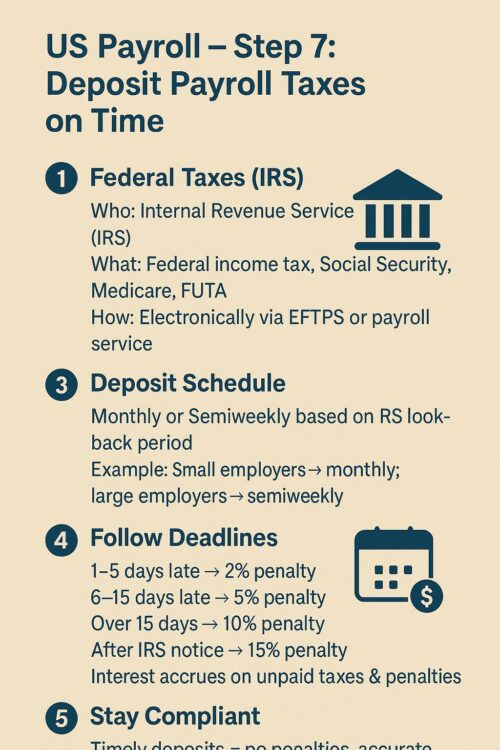

US Payroll – Step 7: Deposit Payroll Taxes on Time (to Federal Taxes (IRS) / State Taxes (State Agencies)

Bytaxtium💼US Payroll – Payroll Tax Deposits :- 1️⃣ Federal Taxes (IRS): *Who: Internal Revenue Service (IRS) *What: Federal income tax withholding, Social Security, Medicare, FUTA *How: Electronically via EFTPS (Electronic Federal Tax Payment System) or through payroll service 2️⃣ State Taxes (State Agencies): *Who: Your state’s Department of Revenue or equivalent *What: State income tax…

Expense / deduction-related forms (flow into Form 1040 Adjustments, Deductions, Credits)

Bytaxtium*1098 → Mortgage interest, real estate taxes *1098-E → Student loan interest *1098-T → Tuition & education expenses *Schedule A → Itemized deductions (medical, mortgage, taxes, charity, etc.) *Schedule C → Business expenses (for self-employed) *Schedule E → Rental property expenses *Schedule F → Farm expenses *Form 2441 → Child & dependent care expenses (credit)…

Form 3520 – Transactions with Foreign Trusts

Bytaxtium📋 Form 3520 – Transactions with Foreign Trusts :- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. 📘 Purpose:- Used by U.S. persons (citizens, residents, or entities) to report certain transactions with foreign trusts or receipt of large gifts or inheritances from foreign individuals or entities. 📋 You must…

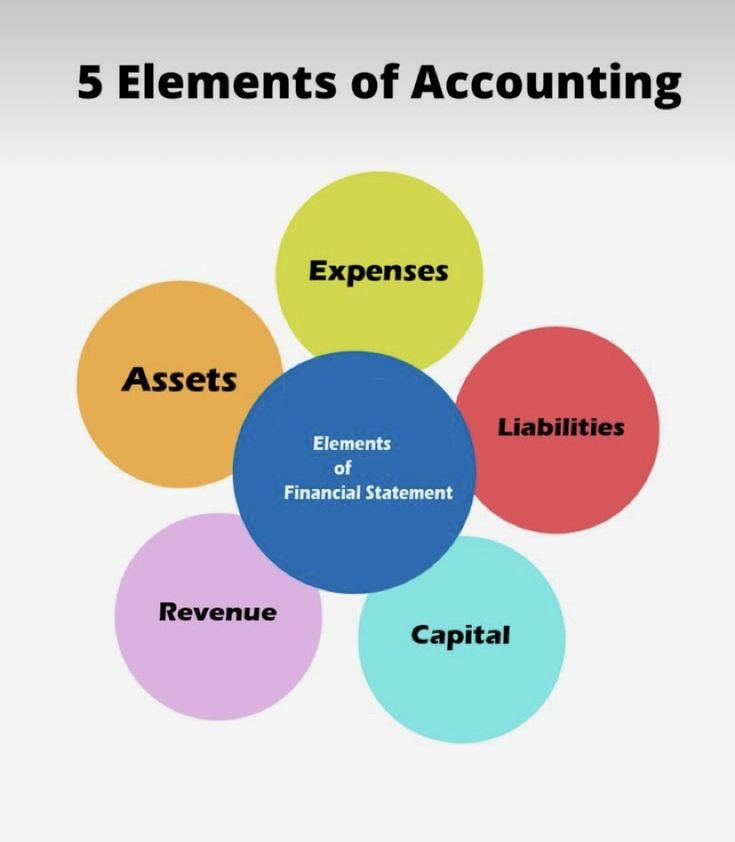

Understanding the 5 Key Elements of Accounting

Bytaxtium5 Major Elements of Accounting Accounting is the language of business, and its foundation rests on five key elements. Mastering these is essential for anyone in finance, management, or entrepreneurship. 1. #Assets Resources owned by a business that provide future economic benefits. Examples: Cash, Inventory, Equipment, Investments 2. #Liabilities Obligations a business owes to outsiders….

𝗗𝗶𝗱 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄 𝗧𝗵𝗮𝘁 𝗖𝗹𝗮𝗶𝗺𝗶𝗻𝗴 𝗮 𝗗𝗲𝗽𝗲𝗻𝗱𝗲𝗻𝘁 𝗣𝗮𝗿𝗲𝗻𝘁 𝗖𝗼𝘂𝗹𝗱 𝗖𝗼𝗺𝗽𝗹𝗲𝘁𝗲𝗹𝘆 𝗙𝗹𝗶𝗽 𝗬𝗼𝘂𝗿 𝗧𝗮𝘅 𝗙𝗶𝗹𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆?

BytaxtiumMost married taxpayers file jointly (MFJ) thinking it’s always the best route. But here’s something most don’t pause to re-check during tax prep season: 📌 If you’re supporting your elderly parent, and your income hits certain thresholds… ➡️ 𝗛𝗲𝗮𝗱 𝗼𝗳 𝗛𝗼𝘂𝘀𝗲𝗵𝗼𝗹𝗱 (𝗛𝗢𝗛) 𝗺𝗶𝗴𝗵𝘁 𝘀𝗮𝘃𝗲 𝘆𝗼𝘂 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗠𝗙𝗝 𝘄𝗼𝘂𝗹𝗱. 𝗟𝗲𝘁 𝗺𝗲 𝗯𝗿𝗲𝗮𝗸 𝗶𝘁 𝗱𝗼𝘄𝗻: 📁…

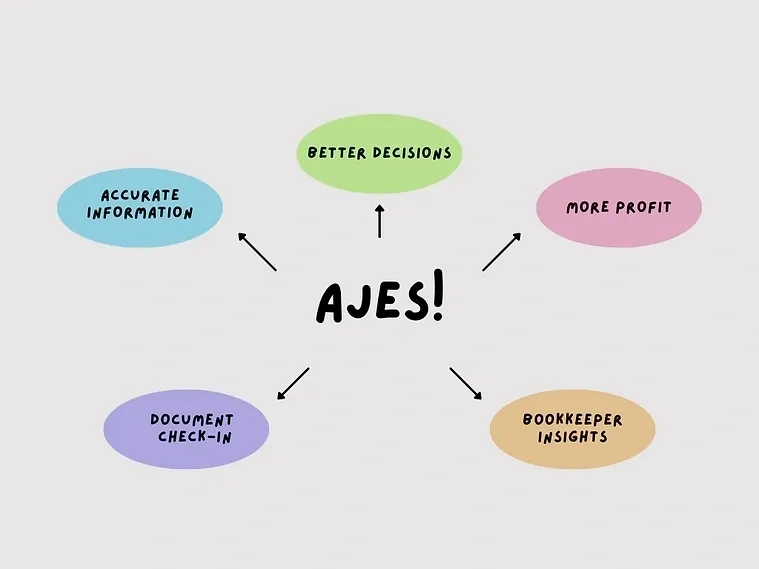

Hey friends! 👋

Ever wonder why accountants always talk about AJE (Adjusting Journal Entries) when it’s time to prepare business tax returns in the US? Don’t worry let’s break it down in a simple way! 💡

🔍 What is an AJE?

An Adjusting Journal Entry (AJE) is just a way for accountants to “clean up” or fine-tune the books before closing the year. It ensures everything is accurate and tax-ready!

Think of it like this:

Before you take a selfie 📸, you fix your hair, clean your glasses, and find good lighting. That’s what AJEs dofor your financials!

🧾 Why Are AJEs Important for Tax Returns?

Here are a few reasons:

1. To Match Income & Expenses Correctly

Let’s say you received a payment in December but didn’t deliver the service until January. An AJE helps move that income to the right year, so your tax return reflects the real picture.

2. To Record Missing Entries

Sometimes, expenses like depreciation, interest, or accruals weren’t booked during the year. AJEs help catch and record them before finalizing the return.

3. To Align with Tax Rules

Some adjustments are required to follow tax laws—like adjusting meals, entertainment, or depreciation to IRS rules.

Examples:

Let’s say your business bought a machine for $1,20,000.

You forgot to post depreciation.

📉 Without AJE: Profit = $5,00,000

💡 With AJE ($24,000 depreciation): Profit = $4,76,000

👉 You save tax on $24,000! 🧠💰

Now meet Rachel 👩💼

She paid $1,20,000 rent in advance for 12 months but recorded it all in April.

❌ Books show huge April expense

✅ AJE spreads $10,000/month = Clean, accurate P&L

🎯 Moral of the story?

AJEs = Your books’ last-minute glow-up 💅 before meeting the taxman!