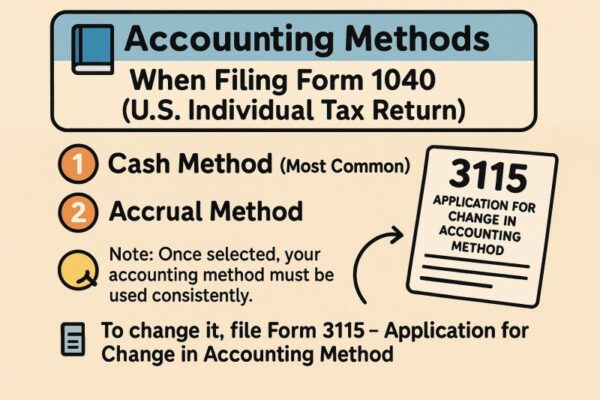

10 – Accounting Methods When Filing Form 1040 (U.S. Individual Tax Return)

📘 Accounting Methods When Filing Form 1040 (U.S. Individual Tax Return)

When reporting income and expenses, the IRS allows individuals to use one of the following accounting methods:

1️⃣ Cash Method (Most Common)

✅ Income is reported when received

✅ Expenses are deducted when paid

🧾 Simple and ideal for employees, freelancers & small businesses

2️⃣ Accrual Method

📊 Income is reported when earned (even if not received)

📉 Expenses are deducted when incurred

🔍 Typically used by businesses with inventory or complex operations

3️⃣ Hybrid Method

🔄 A mix of cash & accrual

📦 Common for businesses tracking inventory

(e.g., accrual for sales, cash for expenses)

🔄 Note: Once selected, your accounting method must be used consistently.

📄 To change it, file Form 3115 – Application for Change in Accounting Method