07b – Standard Deduction

🧾 Standard Deduction: –

✅ What is the Standard Deduction?

A fixed dollar amount that reduces from your taxable income

No need to provide receipts or itemize expenses

Automatically applied unless you choose to itemize deductions

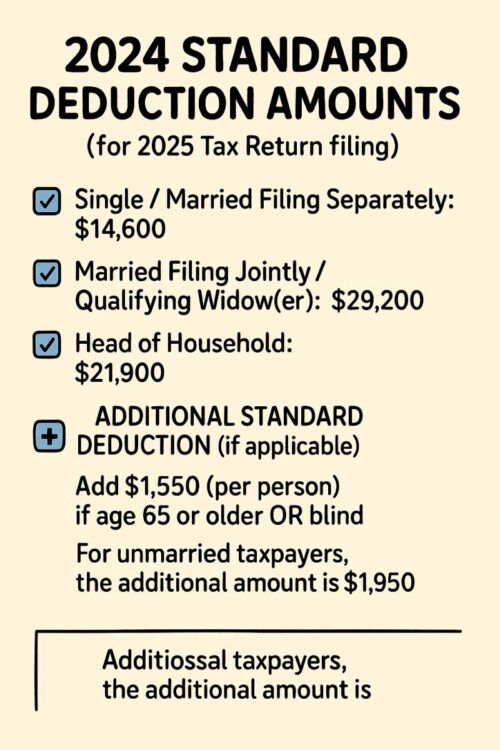

📌 2025 Standard Deduction Amounts (for Tax Returns filed in April 2026):

Single / Married Filing Separately: $15,750

Married Filing Jointly / Qualifying Widow(er): $31,500

Head of Household: $23,625

➕ Additional Standard Deduction (if applicable):

Add $1,600 (per person) if age 65 or older OR blind

For unmarried taxpayers, the additional amount is $2,000

🟩 Who Should Take It?

Most taxpayers — especially if they don’t have high deductible expenses

Ideal for simpler returns with no mortgage, large donations, or major medical expenses

📝 No Documentation Required, but keep records in case your filing status or age-based eligibility is questioned

💡 Tip: Always compare your itemized deductions (Schedule A) against the standard deduction — use whichever is higher to reduce your tax