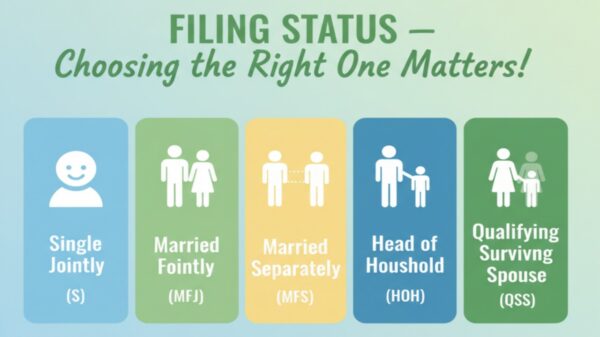

04 – Topic: Tax Filing Status

Topic: Tax Filing Status

- Single,

- Married Filing Jointly (MFJ),

- Married Filing Separately (MFS),

- Head of Household,

Qualifying Widow(er)The IRS provides five filing statuses, which determine the standard deduction and tax brackets.

1️⃣ Single

🔹 Applicable if you’re not married, divorced, or legally separated as of 12/31.

The simplest status there is. You’re Single if, on December 31 of the tax year, you’re not married, legally separated, or divorced. That’s it.

You don’t qualify as Head of Household, and you don’t have a dependent that changes your status. Most young adults, college grads, and anyone living independently fall under this category.

Example: Chris is 29, works full-time, and isn’t married or supporting anyone. He lives by himself, pays his own bills, and no one can claim him as a dependent. Chris files Single on his 1040.

Common mistake: People sometimes think they can file as Head of Household just because they help family with money. But unless you provide over half the cost of maintaining a home for a qualifying dependent, you’re still considered Single.

2️⃣ Married Filing Jointly (MFJ)

🔹 Both spouses agree to file a joint return.

🔹 Return must be signed by both.

🔹 Exceptions:

❌ One spouse is a Non-Resident Alien

❌ Different accounting years

If you’re legally married on the last day of the year, you can file a joint return with your spouse. This combines both of your incomes, credits, and deductions into one tax return.

Joint filing is the most common choice for married couples because it’s usually simpler and offers better overall tax treatment than filing separately. However, both spouses are jointly responsible for the information and any tax due—so trust and transparency are key.

Example: Jordan and Taylor got married in October. Jordan earned $80,000, and Taylor earned $40,000. Since they’re married by December 31, they can file Married Filing Jointly for the entire year.

Why some couples choose this: It simplifies paperwork, allows for shared credits, and avoids duplication of forms. But it also means if one spouse forgets to report income or owes back taxes, both are liable.

3️⃣ Married Filing Separately (MFS)

🔹 Married as of 12/31 but choose to file separate returns.

🔹 Often used for tax or legal reasons.

This status is for couples who are legally married but want or need to file their taxes individually. Each spouse reports only their own income, deductions, and credits.

It’s not common, but there are legitimate reasons to do it. Some people don’t want to be held responsible for their spouse’s tax situation. Others might have specific financial circumstances—like high medical expenses or ongoing legal issues—where separate filing makes sense.

Example: Alex and Morgan are married, but Morgan owes back taxes from years ago. Alex doesn’t want their joint refund to be taken by the IRS to pay off Morgan’s debt. To avoid that, they file Married Filing Separately.

Things to keep in mind:

- Both spouses must either itemize or not—one can’t do one while the other doesn’t.

- Many tax credits and deductions are limited or unavailable when filing separately.

- Separate returns can be useful if the couple is separated, divorcing, or maintaining financial independence.

This filing status is mainly about boundaries—financial and legal ones.

4️⃣ Head of Household

🔹 Unmarried or considered unmarried.

🔹 Must pay more than half the cost of maintaining a home for self and a qualifying person (like a child or dependent relative).

🔹 Often results in a lower tax rate than Single.

This one is often misunderstood, but it can be incredibly beneficial for those who qualify. You file as Head of Household (HOH) if you’re unmarried (or considered unmarried) and you provide more than half the cost of maintaining a home for a qualifying person—usually a child or dependent relative.

To qualify:

- You must be unmarried or considered unmarried on December 31.

- You must have paid more than half the cost of keeping up your home during the year.

- A qualifying dependent (child, parent, or relative) must have lived with you for more than half the year, except in cases like a parent you support who doesn’t live with you.

Example: Jamie is a single mother of a 7-year-old son, Leo. She works full-time and pays all the household bills. Leo lives with her the entire year, and no one else claims him. Jamie qualifies as Head of Household because she provides over half the support for a dependent and is unmarried.

Why people get it wrong: Many taxpayers claim HOH incorrectly by assuming financial support alone qualifies them. The IRS specifically requires a dependent relationship and proof that you pay most of the household expenses.

This filing status recognizes single-income households that carry family responsibilities—it’s meant to ease that burden a bit.

5️⃣ Qualifying Widow(er)

🔹 For two years following a spouse’s death.

🔹 Must have a dependent child to qualify.

🔹 Offers the same benefits as Married Filing Jointly.

This status is available for two years following the death of a spouse, provided certain conditions are met. It’s designed to help surviving spouses adjust financially while they’re still supporting a dependent child.

To qualify:

- You were eligible to file jointly in the year your spouse died.

- You haven’t remarried before the end of the current tax year.

- You have a dependent child living with you for the entire year.

Example: Riley’s spouse passed away in 2023. They had a 10-year-old daughter, Ella, who continues to live with Riley. For 2024 and 2025, Riley can file as a Qualifying Surviving Spouse. After that two-year period, Riley would likely file as Head of Household as long as Ella is still a dependent.

Why it exists: This status provides short-term stability. Losing a spouse is already emotionally and financially overwhelming, and the IRS recognizes that by allowing surviving spouses to file under the same terms as married couples for two additional years.

✅ Filing the correct status can reduce tax liability and increase eligibility for credits.

📌 Choosing the correct status is essential for accurate tax filing and maximizing deductions!

Bringing It All Together

Your filing status is more than a box to check—it determines how the IRS views your household structure and responsibilities. It reflects your personal life in legal and financial terms.

Here’s a quick way to think about each one:

- Single: You’re on your own—no dependents, no spouse.

- Married Filing Jointly: You and your spouse combine everything and share responsibility.

- Married Filing Separately: You’re married but keeping finances and liabilities apart.

- Head of Household: You’re unmarried but supporting a qualifying dependent.

- Qualifying Surviving Spouse: You’ve lost your spouse recently and are still supporting a child.

Each status has its own rules and implications, and choosing the wrong one can cause processing delays or missed benefits.

When in doubt, don’t guess—check the IRS guidelines or talk to a professional. The right filing status isn’t about getting the biggest refund; it’s about accurately reflecting your situation and staying compliant with tax law.